by Wandile Sihlobo | May 17, 2019 | Food Security

With South Africa’s meat prices being in deflation over the past few months, one would easily assume that the beef industry has recovered from the 2015/16 drought which led to a reduction in the herd. Figure 1 illustrates South Africa’s cattle herd, and boy, we are not back to levels we were before the drought.

Figure 1: South Africa’s cattle herd

Source: DAFF, Agbiz Research

So, where did the illusion that cattle herd has somewhat recovered come from?

You see, the years following this period of higher cattle slaughtering when farmers couldn’t feed their stock — 2017 and 2018 — was for rebuilding the herds, which meant a reduction in slaughtering pace. This process was reflected on meat prices, which at the time were rising double digits, particularly from February 2017 until March 2018. Thereafter, we started to see some cooling off in meat prices, as slaughtering activity, on a monthly basis, began to gain momentum, albeit not back at levels during 2015/16 drought. In March 2019, South Africa’s meat prices were actually in deflation, registering -1.1%, according to data from Stats SA.

But the factors leading to the deflation in meat prices wasn’t a recovery in slaughtering activity, but the ban on South Africa’s red meat exports following the outbreak of the foot-and-mouth disease in Limpopo earlier in the year. The theory at the time, simplistically, was that a ban on exports would lead to increased domestic meat supplies, and therefore a decline in prices. It had less to do with the herd rebuilding progress.

Because of this, the meat price deflation story could soon be over because of the following. First, a number of African and Middle East countries have recently lifted the ban on South Africa’s beef exports. This means the impact of the foot-and-mouth disease might not be as severe as initially expected. Second, it is worth noting that South Africa’s cattle slaughtering activity is slowing, and this could add support to prices in the near term. Third, aside from red meat, poultry products prices could lift somewhat in the coming months, as there is likely to be an uptick in import tariffs.

Follow me on Twitter (@WandileSihlobo). E-mail: wandile@agbiz.co.za

by Wandile Sihlobo | Apr 24, 2019 | Food Security

Animal health is increasingly becoming a key issue in South Africa. This year we’ve had cases of foot-and-mouth disease in the beef industry, and African swine fever in the pork industry. But the degree of impact to each industry has differed. In the case of beef, the disease outbreak led to a temporary ban on South Africa’s beef exports in some countries. And it also negatively affected our wool trade with China.

But African swine fever did not have a notable impact on the pork industry. The first reported case was on a farm in North West earlier this month, and it affected specifically wild pigs. The outbreak was detected early, with good response from the government veterinarians. There was no threat to the South African pork industry nor consumers, as is still the case.

But today, 24 April 2019, the South African Pork Producers’ Organisation notified us of another diagnosis on a small farm in the Delmas area of Mpumalanga. The farm had about 180 pigs, mainly fattening pigs and a few sows bought from an auctioneer in the area. The source of the disease is unclear at this point, and the provincial veterinary services and industry players are hard at work to get to the root of it. The farm was immediately quarantined.

The South African Pork Producers’ Organisation boss, Johann Kotzé, says while this is worrying, there is no imminent threat to the industry, nor consumers. As in the North West case, the outbreak was detected early, with good response from the government veterinarians.

On a broader level, as I said in my previous post, African swine fever is a serious disease. A recent report from the Food and Agricultural Organization of the United Nations suggests that China has culled over 1 million pigs in an effort to control its spread since 03 August 2018. For perspective – this is equal to 71% of South Africa’s pig herd.

OK, let me not be alarmist – after all, China produces more than half the world’s pigs – roughly 700 million a year.

Fortunately, South Africa is nowhere close to what we are witnessing in China. I am hoping that the outbreak is controlled successfully. I will provide an update on this matter if there are any new developments in the coming days.

Follow me on Twitter (@WandileSihlobo). E-mail: wandile@agbiz.co.za

by Wandile Sihlobo | Apr 17, 2019 | Food Security

South Africa’s food price inflation numbers continue to surprise us. The figures recently released by Statistics South Africa show that food price inflation remained unchanged in March 2019 at 2.3% for the third consecutive month.

But the products price inflation movements within the food price inflation basket were mixed. The price inflation for most food products categories lifted from the previous month, with the exception of meat, which remained in deflation, registering -1.1% in March 2019.

The uptick in prices of most food products is reflective of the movements of agricultural commodity prices which have increased in the previous months due to expectations of lower harvest, amongst other factors. The most notable one being grains, where SAFEX yellow and white maize prices have consistently been over 20% higher than levels seen last year since January 2019.

But this has done little to lift the headline food price inflation, as it was offset by lower meat prices, which account for more than a third of the food price inflation basket. The softer meat prices were partly underpinned by expectations of an increase in domestic meat supplies as the outbreak of foot-and-mouth disease at the beginning of this year led to a ban on South Africa’s beef in key export markets.

This might change in the coming months, however, as South Africa is currently engaging with a number of countries to re-open export markets for beef in Africa and the Middle East regions. This means the impact of the foot-and-mouth disease might not be as severe as initially expected.

Also, worth noting is that South Africa’s cattle and sheep slaughtering activity is slowing, and this could add support to prices in the near term, as shown in Figure 1 below.

Figure 1: South Africa’s cattle and sheep slaughtering is slowing

Source: Red Meat Levy Admin, Agbiz Research

Aside from red meat, poultry products prices could lift somewhat in the coming months, as there is likely to be an uptick in import tariffs. In terms of pork, prices could move sideways in the coming months, as there is no imminent threat from the recent African swine fever outbreak in North West.

Hence, I am of the view that the lower food inflation story could soon be over. At Agbiz, we still think South Africa’s food and non-alcoholic beverages price inflation could average about 5% y/y in 2019.

Follow me on Twitter (@WandileSihlobo). E-mail: wandile@agbiz.co.za

by Wandile Sihlobo | Apr 10, 2019 | Food Security

The South African government has detected an outbreak of African swine fever on a farm in North West. The African swine fever is a fatal animal disease affecting pigs and wild boars with up to 100% mortality, but it is harmless to humans.

Now, the reports suggest that the outbreak killed 32 out of a herd of 36 pigs on a farm in the Ditsobotla district in North West. I’ve confirmed this with the CEO of the South African Pork Producers’ Organisation, Mr Johann Kotze, who has clarified that these were specifically wild pigs.

The local authorities are currently on the ground collecting evidence. From what I gathered in my conversation with the South African Pork Producers’ Organisation boss, there is no imminent threat to the South African pork industry nor consumers – so, go on folks and eat your bacon, ribs, pork belly sandwiches, etc.

The outbreak was detected early, with good response from the government veterinarians, who are now hard at work to ensure that it is controlled.

But African swine fever is a serious disease. A recent report from the Food and Agricultural Organization of the United Nations suggests that China has culled over 1 million pigs in an effort to control its spread since 03 August 2018. For perspective – this is equal to 71% of South Africa’s pig herd.

OK, let me not be alarmist – after all China produces more than half the world’s pigs – roughly 700 million a year.

Fortunately, South Africa is nowhere closer to what we are witnessing in China. I am hoping that the outbreak is controlled successfully. I will provide an update into this matter if there are any new developments in the coming days.

Follow me on Twitter (@WandileSihlobo). E-mail: wandile@agbiz.co.za

by Wandile Sihlobo | Apr 9, 2019 | Food Security

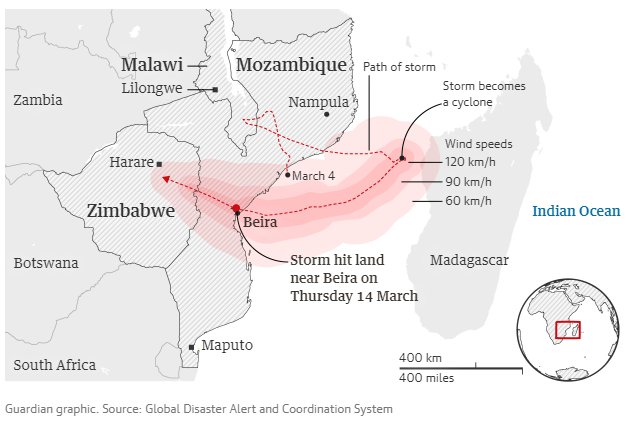

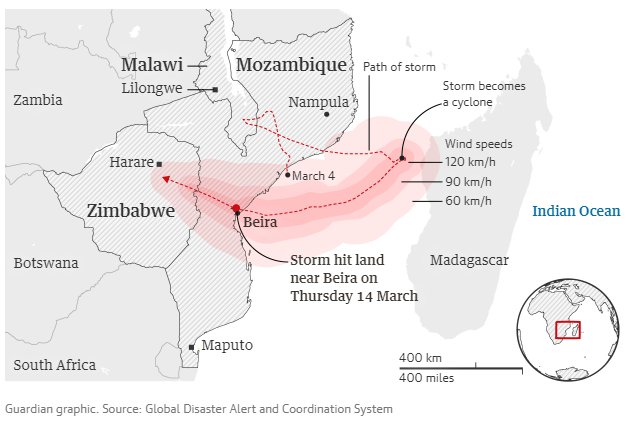

While it remains a challenge to get a clear picture of the scale of damage to maize fields in Mozambique, Malawi and Zimbabwe after Cyclone Idai, my back-of-the-envelope calculations suggest these countries will collectively have to import more than 1-million tonnes of maize in the 2019/2020 marketing year to meet their domestic needs.

In the case of Zimbabwe, 2019/2020 maize imports could reach at least 900,000 tonnes to meet the annual consumption of about 2-million tonnes. Meanwhile, Mozambique will most likely double its typical maize import volume of about 100,000 tonnes a year to fulfil a domestic need of about 2.3-million tonnes. For Malawi, imports could amount to at least 200,000 tonnes. The key question is where these countries will source these additional supplies.

In the recent past SA, Zambia and Mexico have been the main suppliers of maize to Mozambique, Malawi and Zimbabwe. But in 2019 conditions could change somewhat as supply from SA and Zambia is expected to be tight due to forecasts of poor harvests. If we assume SA’s expected production of 10.6-million tonnes materialises, the country could have only about 1.1-million tonnes of maize available for export. A large share of this will most likely be destined for Botswana, Namibia, Lesotho and Eswatini, which won’t leave much for Mozambique, Malawi and Zimbabwe.

From a Zambian perspective, the International Grains Council forecasts the country’s 2018/2019 maize harvest at 2.4-million tonnes, down 33% year on year (the 2018/2019 production season corresponds with the 2019/2020 marketing year). This, however, will not make Zambia a net importer of maize, especially if we account for its carry-over stock of about 785,000 tonnes, which will boost supplies in the 2019/2020 marketing year.

Given that Zambia’s maize consumption is about 2.4-million tonnes, the aforementioned volumes should be sufficient to satisfy the domestic market. The volume available for export will largely depend on government decisions about the volume of maize to be kept in Zambia’s strategic grain reserves — a typical policy approach in the country.

This indicates that maize supplies will be tight in Southern Africa in the 2019/2020 marketing year, which could put upward pressures on prices. Fortunately, disaster can be averted as there are large supplies in the global maize market for the region to draw from, although it is largely yellow maize. The US agriculture department forecasts 2018/2019 global maize production at 1.1-billion tonnes, up 2% from the previous season.

My opening question was where Mozambique, Malawi and Zimbabwe might import additional maize supplies from. The answer is that the most likely suppliers of maize, not only to the aforementioned countries but to the entire Southern African region in the coming months, will be Argentina, Mexico, Ukraine, Russia and the US.

I should also point out that although I expect SA’s maize exports to amount to 1.1-million tonnes in the 2019/2020 marketing year, which starts on May 1, the country could import about 250,000 tonnes of maize to be utilised in the coastal provinces. Therefore, the benefit of large global supplies will not only be for Mozambique, Malawi and Zimbabwe, but also for SA.

In addition, it is worth noting that while global maize production is expected to increase in the 2018/2019 season, prices might not decline notably due to expectations of a rise in global consumption. This is evident in the UN’s Food and Agriculture Organisation global cereal price index, which averaged 169 points in February 2019, up 4% from the corresponding period in 2018.

The overarching message is that Southern Africa’s maize supplies will be tight in 2019, and that could lead to an uptick in commodity prices and ultimately food price inflation. But the situation can be managed if the states in the region manage the logistics of their maize imports from global suppliers efficiently.

*Written for and first published on Business Day on 03 April 2019.

Follow me on Twitter (@WandileSihlobo). E-mail: wandile@agbiz.co.za

by Wandile Sihlobo | Mar 30, 2019 | Africa Focus, Agricultural Environment and Natural Resource, Agricultural Labour Market, Agricultural Production, Agricultural Trade, Food Security, General Comments, Land Reform

It is hard to get a clear picture of crop conditions in Zimbabwe after Cyclone Idai. But reports from a number of media outlets who have people on the ground paint a concerning picture. This afternoon, Al Jazeera came out with a headline — Cyclone Idai destroys Zimbabwe farms, deepening food crisis — telling readers that the damage caused by the cyclone could lead to Zimbabwe importing 900 000 tonnes of maize in 2019/20 in order to fulfil its domestic needs.

In addition, the United States Agency for International Development also released a note with a headline – Effects of Cyclone Idai negatively affect livelihoods decreasing food access in parts of Zimbabwe. This echoed the same message as the Al Jazeera story, although not specifying the volume of possible maize imports for the year.

Also today, NewsDay, a Zimbabwean newspaper, citing the country’s Lands and Agriculture ministry permanent secretary, Ringson Chitsiko, indicated that current stocks of maize and small grains at the Zimbabwe Grain Marketing Board stand at 832 156 tonnes, and at the current monthly drawdown rate of 120 000 tonnes, the available grain is sufficient to last about seven months. This sounded a bit ambitious compared to what we have been gathering over the past few month. Nonetheless, the same article noted the prevalence of food insecurity in some parts of Zimbabwe, which could increase following the cyclone.

To recap — before the cyclone, Bulawayo24, a Zimbabwean newspaper, citing Zimbabwe Commercial Farmers Union, indicated that Zimbabwe’s maize production could amount to 900 000 tonnes in 2018/19 production season. This is well below the International Grains Council estimate of 1.2 million tonnes.

Now, given that Zimbabwe’s maize carryover stock of roughly 458 000 tonnes from the 2018/19 marketing year might not be sufficient to boost its maize supplies in the 2019/20 marketing year, the country could remain a net importer of maize (2019/20 marketing year corresponds with 2018/19 production season).

If we account for the fact that Zimbabwe’s maize consumption typically varies between 1.8 million and 2.0 million tonnes, then maize imports for the 2019/20 marketing year were most likely going to amount to 700 000 tonnes. But this was before the crop damage by the cyclone that occurred this month.

At this point, I have no idea how much maize Zimbabwe will need, but the 900 000 tonnes cited by Al Jazeera is starting to look believable.

Follow me on Twitter (@WandileSihlobo). E-mail: wandile@agbiz.co.za

by Wandile Sihlobo | Mar 24, 2019 | Food Security

The situation in Mozambique is devastating. Tropical Cyclone Idai, which hit the coastline of Mozambique on March 14th has caused a heavy loss of lives and affected more than 600 000 people, according to some estimates – the number will most likely rise after on-ground assessments. Amid continuing efforts to find survivors, one of the key concerns over the coming days will be food insecurity, due damage to both crop fields and port infrastructure.

Mozambique is generally a net importer of major grains, such as maize, wheat and rice. In a normal season, the country imports roughly 100 000 tonnes of maize, 700 000 tonnes of rice, and 680 000 tonnes of wheat to fulfil its domestic needs. Maize imports are largely transported on land as these are mainly from South Africa and Zambia. Meanwhile, wheat and rice imports originate from Europe, and Asia through Beira Port, which is the area that has been affected by the Cyclone.

Given that domestic production of rice and wheat is relatively negligible, the devastation from the cyclone will not lead to meaningful changes in import requirements of these commodities from the aforementioned volumes. However, the challenge will be on the infrastructure side in the ports.

In the case of maize, the imports will most likely increase from an average volume of 100 000 tonnes per the calendar year. At this point, I don’t know how much will be required. I will have a better sense as soon as we are aware of the scale of damage in the maize fields. This all means that there will be increased pressure in Southern Africa maize supplies this year. After all, even the key maize producing countries in the region – South Africa and Zambia – are expecting a double-digit decline in harvest in 2018/19 season. It is a tough year ahead – all due to mother nature!

Follow me on Twitter (@WandileSihlobo). E-mail: wandile@agbiz.co.za