Here is a new home for my writings

If you are keen on reading my work, please consider subscribing to my Substack...

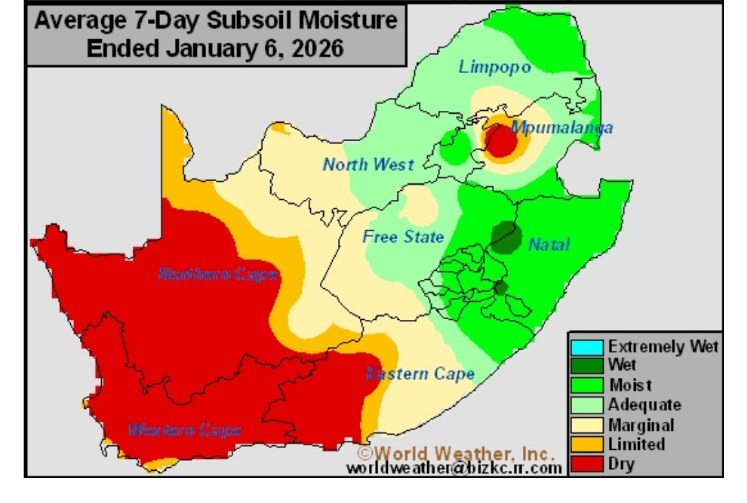

Soil Moisture Across South Africa

The recent rains have been widespread across South Africa, benefiting agricultural activity.

Cherries in South Africa

Many South Africans enjoyed their cherries in recent months. In fact, during the December 2025 holidays, I noticed many people were excited about the availability of cherries in their local stores and their reasonable prices. We will likely continue to see more cherries in our stores when they are in season in the coming years.

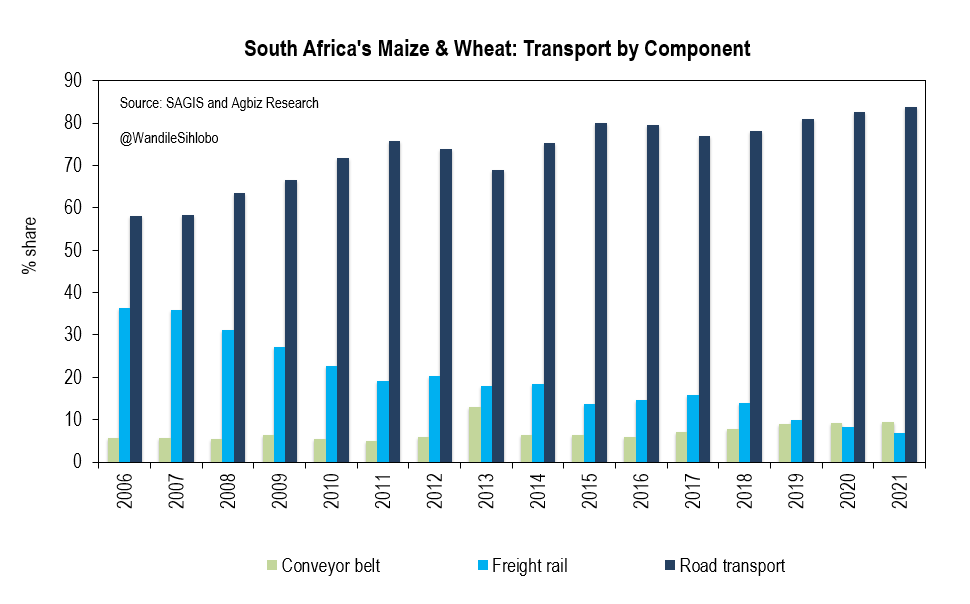

Easing fuel prices will benefit the SA agricultural sector

We will get a reprieve on fuel prices from today, January 7, 2026. The diesel price...

What to Make of 2025 in South Africa’s Agriculture, and Outlook for 2026?

2025 was a generally good year for South Africa’s agriculture and the broader Southern Africa farming sector. We emerged from a drought and heatwave in 2024 and saw excellent harvests of crops, fruits, and vegetables.

Agricultural observations from driving across parts Of Kwazulu-Natal

On December 28, 2025, we drove across the various regions of KwaZulu-Natal (KZN), which offered an opportunity to view the agricultural conditions from a distance. Like most regions of South Africa, the vegetation and grazing veld look green and lush. This helps the livestock industry, and KZN is one of South Africa’s central dairy-producing provinces, with also a substantial number of livestock among subsistence farmers.