by Wandile Sihlobo | Jan 25, 2026 | General Comments

If you are keen on reading my work, please consider subscribing to my Substack newsletter. I publish notes regularly, and they will be delivered to your inbox. You can subscribe for free here: https://wandile.substack.com/

by Wandile Sihlobo | Jan 9, 2026 | Agricultural Environment and Natural Resource

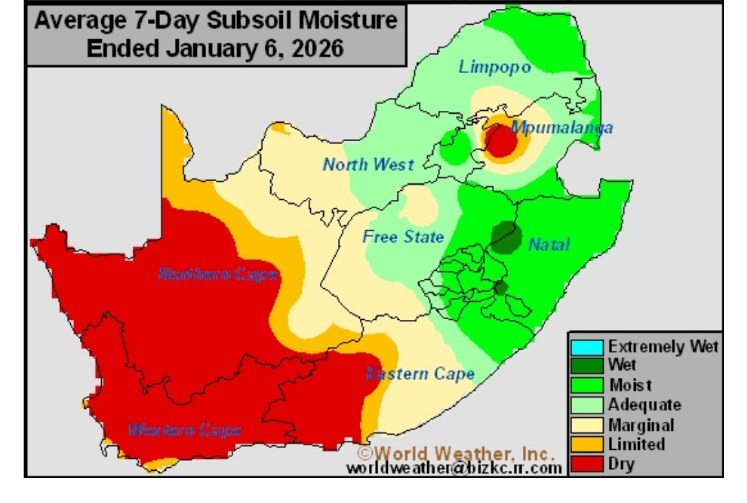

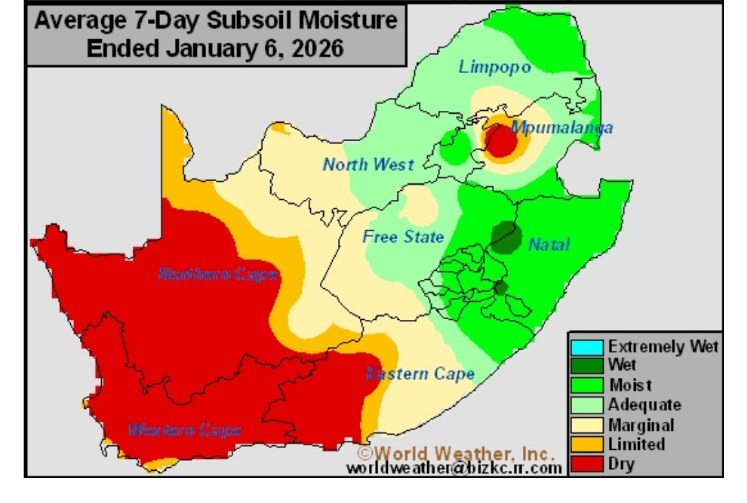

The recent rains have been widespread across South Africa, benefiting agricultural activity.

In the summer grains and oilseeds regions, the farmers have been able to plant a sizable area, and some are at the tail end of the planting. There is no panic, and we should be able to meet the expected area of 4.5 million hectares, up 1% from the 2024-25 season.

Some regions are excessively wet, such as KwaZulu-Natal and the northern Eastern Cape. Still, there are no concerns that this would negatively affect crops.

The rains have also benefited the grazing veld, which is beneficial to the livestock industry. South Africa’s fruits and vegetables are all irrigated, which means higher dam levels will help throughout the winter season.

Moreover, frequent rains also mean less irrigation in some areas than usual, which saves energy costs.

The Western Cape is a winter-rainfall area; therefore, we should not be alarmed by the low soil moisture there. They will start receiving nice rains around the end of April.

What remains worrying is the southern Eastern Cape, which hasn’t received much rain at all. We will closely monitor conditions in these regions going forward.

The Eastern Cape is a summer rainfall area, and the southern region should ideally be receiving more rain now. What remains comforting is that the dam levels are healthy and are helping with irrigation for fruit crops in these regions.

Overall, the 2025-26 agricultural season is expected to be favourable for South Africa.

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)

by Wandile Sihlobo | Jan 7, 2026 | Agricultural Environment and Natural Resource

Many South Africans enjoyed their cherries in recent months. In fact, during the December 2025 holidays, I noticed many people were excited about the availability of cherries in their local stores and their reasonable prices. We will likely continue to see more cherries in our stores when they are in season in the coming years.

South Africa has been increasing its cherry production due to strong domestic and global demand. For example, in 2012, South Africa had 185 hectares of cherry plantings, and by 2024, the area had increased to 819 hectares, according to data from Hortgro, a horticulture producers organisation.

South Africa’s cherry production in 2025 was at a record 3,006 tonnes. About 58% of cherries are exported, 28% sold on the local market, and the rest are processed. Moreover, about 60% of South African cherries were exported to the United Kingdom, 18% to the EU and 12% to the Middle East. As production increases, we will likely be listing cherries more often in our export conversations as the industry seeks to broaden its export markets to countries such as China.

Still, there will likely remain sufficient supplies for the local markets. There is great enthusiasm in SA about cherries, and the various social media posts in December 2025 are a testament to this local vibrancy.

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)

by Wandile Sihlobo | Jan 6, 2026 | Agricultural Environment and Natural Resource

We will get a reprieve on fuel prices from today, January 7, 2026. The diesel price (0.05% wholesale inland) could decline by between R1.37 and R1.50 a litre, while the petrol price (95 ULP inland) could fall by 66 cents per litre.

The relatively stronger ZAR/USD, combined with a reasonably lower oil price for much of the month, are the major driver of the decline in fuel prices.

This is a welcome development and bodes well for the South African agricultural sector. We are still in a period of high fuel consumption in South Africa’s agriculture. The planting season for summer grains and oilseed is on its tail end. Fuel accounts for a notable share of grain farmers’ input costs, about 13%.

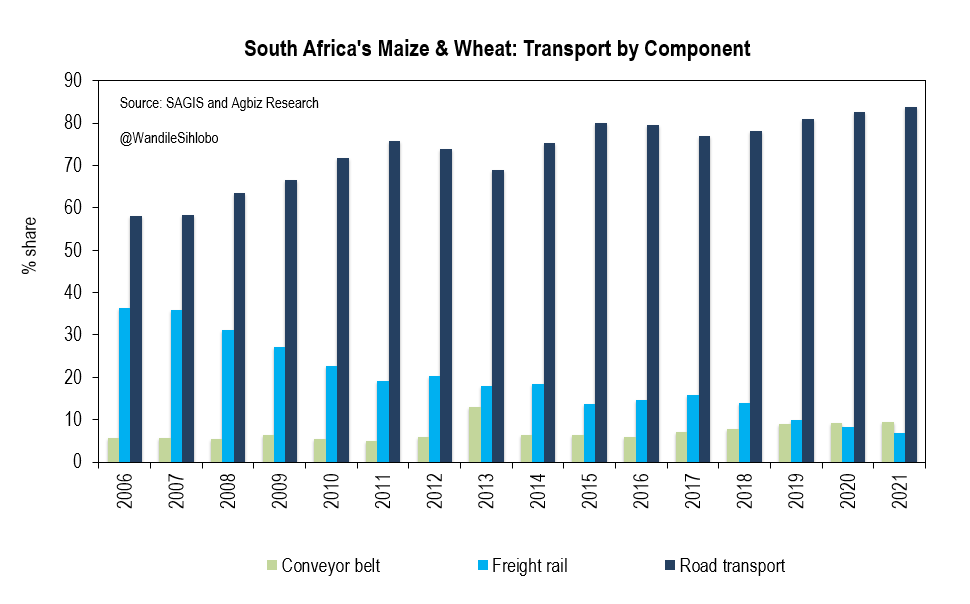

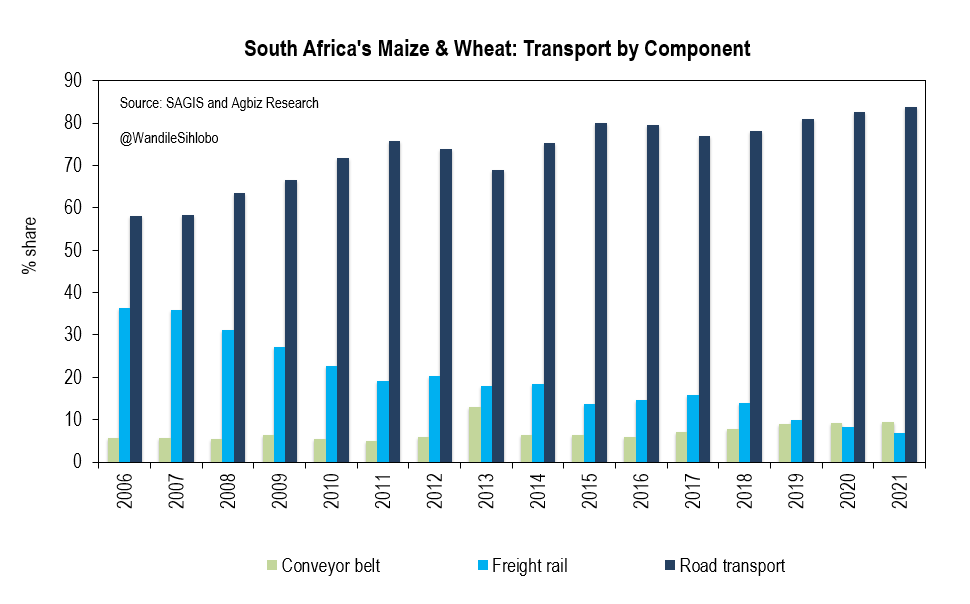

Beyond the farmers, agribusinesses will also benefit from lower costs, particularly in logistics. It is worth noting that roughly 81% of maize, 76% of wheat and 69% of soybeans in South Africa are transported by road.

On average, 75% of national grains and oilseeds are transported by road, as is a substantial share of other agricultural products.

Overall, lower fuel prices are a welcome development that supports the agricultural sector and, ultimately, moderates food prices.

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)

by Wandile Sihlobo | Dec 31, 2025 | Agricultural Environment and Natural Resource

2025 was a generally good year for South Africa’s agriculture and the broader Southern Africa farming sector. We emerged from a drought and heatwave in 2024 and saw excellent harvests of crops, fruits, and vegetables. Indeed, some countries in the region remained net importers of grains and other agricultural products from South Africa and the rest of the world. But import needs were much lower than a year earlier, during a drought.

In South Africa specifically, the broad agricultural sector recovery poses a challenge, however. Foot-and-mouth disease has remained a prominent feature of our cattle industry, imposing high costs on farming businesses. It was only at the end of the year that the government announced its intention to vaccinate the 12.1 million cattle in the national herd. The logistics of this effort and the sourcing of the vaccines remain significant challenges. In a few days from now, when we all emerge from our holiday places, this will likely be one of the preoccupations of the farming sector of South Africa.

We have private-sector companies that, over time, could produce vaccines, and national entities, such as the Agricultural Research Council and Onderstepoort Biological Products, that must be rejuvenated to play this role. So far, we have relied on Botswana to supply us with foot-and-mouth disease vaccines. But the Botswana supply won’t be sufficient, and there are concerns about the vaccine’s potency.

This cattle industry challenge led to what I have termed “a mixed recovery” in South Africa’s agriculture in 2025. The livestock industry is also critical, accounting for roughly half of South Africa’s farming fortunes. Therefore, when the subsector struggles, the impact is felt across the board.

Beyond the cattle industry, other subsectors did well and delivered excellent harvests. It is for this reason that in the first three quarters of 2025, South Africa’s agricultural exports amounted to US$11.7 billion, up 10% year-on-year. When we receive the full-year 2025 data, I suspect that South Africa’s agricultural exports would have exceeded US$13.7 billion in 2024 and possibly crossed US$14 billion. The volumes of exports and prices were generally healthy.

These healthy farming fortunes also extended to the interlinked industries. For example, we have South Africa’s agricultural machinery sales data for the 11 months of 2025. Cumulative tractor sales are 7,176 units, up 19% year-on-year. The combine harvesters’ sales for the 11 months are at 200 units, up by 3%. The sales have generally been robust throughout the year, with combine harvesters only cooling in recent months.

The one challenge that we saw emerge at the end of 2025, which will likely be part of conversations in 2026, is the differing views on trade policy. As the year drew to a close, I saw news from Botswana that they were banning the import of various vegetables from South Africa. Moreover, a few days before Christmas, Mozambique went further in the same direction. Namibia went so far as to ban imports of some poultry products from South Africa.

These are not new issues in this region. We have seen them play out before, and our hope from the start of 2025 was that the new leaders in some countries would embrace the regional spirit and not attempt to limit South Africa’s participation in their markets. What makes this worse is that, for some of the countries, we are part of the Southern African Customs Union (SACU), which was formed in 1910 and comprises Botswana, Eswatini, Lesotho, Namibia, and South Africa. Among other things, this bloc ensures the free exchange of goods with no tariffs. Now that these countries continue this practice, one wonders whether South Africa should remain part of SACU? This will be a discussion point in 2026.

Aside from the regional issues, being part of SACU also slows South Africa’s ambition to broaden its exports and sign free trade agreements with other countries. In every encounter, South Africa must play by the rules and secure the backing of other SACU members. But if the other SACU members have no interest in rules, why should South Africa care?

Beyond these issues, at a production level, we have continued to receive the excellent La Niña rains, which have supported crop conditions and the grazing veld across the country. Thus, I believe that we enter 2026 with far better prospects of a continuous and broad recovery from the already better conditions of 2025. The favourable rains we see here at home are also a reality in some countries in the region, supporting regional agricultural prospects in 2026.

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)

by Wandile Sihlobo | Dec 28, 2025 | Agricultural Environment and Natural Resource

On December 28, 2025, we drove across various regions of KwaZulu-Natal (KZN), offering an opportunity to view agricultural conditions from a distance. Like most regions of South Africa, the vegetation and grazing veld look green and lush. This helps the livestock industry, and KZN is one of South Africa’s central dairy-producing provinces, with a substantial number of livestock among subsistence farmers.

The better grazing veld will help a great deal. For dairy and beef producers, the better veld comes at a time when feed prices are more affordable, with yellow maize prices generally 30% lower than a year ago because of South Africa’s ample harvest in the 2024-25 season. We had the second-largest maize harvest on record in South Africa in the 2024-25 season, at about 16.44 million tonnes, up 28% year-on-year, driven by favourable rains.

The soybean prices, which are also another vital feed, especially for those in poultry production, are down by roughly 26% from a year ago, also because of a large domestic harvest. South Africa had its record soybean harvest in the 2024-25 season, about 2.77 million tonnes.

Of course, this glimpse of positivity doesn’t begin to mask the significant challenge that cattle farmers in KZN, and much of South Africa, face: foot-and-mouth disease. The challenge is particularly acute in the dairy sector, especially in the dairy area, the Midlands region of KwaZulu-Natal.

The central issue on farmers’ minds in the region is the availability of vaccines and the speed at which they can be delivered. This is an area that the leadership at the Department of Agriculture must continue to press on. The focus should be on making sure we have access to vaccines, not just from Botswana, but also from other sources such as Turkey.

Beyond vaccine imports, the point I made previously about South Africa rejuvenating its foot-and-mouth vaccine production capability remains vital. This should not just be the state-owned entities, the Agricultural Research Council and Onderstepoort Biological Products (OBP), but also the private entities that have the capacity. We need to vaccinate a herd of roughly 12.1 million cattle in this country several times.

Back to KZN, in terms of crop farming, the province, like the rest of South Africa, received excessive rainfall across various regions. Still, farmers have managed to plant, and the crops look promising across multiple areas, mainly maize, soybeans, and sugarcane. Of course, the horticulture fields look great as well.

In the households we saw across the various villages, people’s gardens looked great, and it appears the rains have been broadly beneficial.

Of course, we will have a clearer sense of the area farmers planted to summer grains and oilseeds for the 2025-26 season in February 2026, when the Crop Estimates Committee releases the data. But from what we continue to observe as we drive around during this summer holiday period, the agricultural activity looks promising.

These La Niña rains have delayed plantings in other regions of the country. Still, I generally remain hopeful that farmers will continue to use the windows of warm weather to advance plantings in areas that haven’t yet planted. We have until mid-January 2026 to push planting.

Indeed, January is not an ideal time, and it is later than usual. But we have had late plantings before and still managed to get a good crop. In fact, the very excellent harvest of the 2024-25 season in maize and soybeans that I mentioned above was roughly a month and a half behind its typical schedule.

Therefore, I am not concerned for now and remain upbeat that we could still have a better harvest in the 2025-26 season. What I saw in the various regions of KZN gives some comfort. But vaccination for the cattle industry is critically needed.

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)

by Wandile Sihlobo | Dec 21, 2025 | Agricultural Production

This rainy weather, while an inconvenience at times in social activities, continues to help us in agriculture. The grazing veld is improving nicely across the country. Those in fruit and vegetable farming also don’t have to irrigate as much as on generally warmer days.

In the grains, oilseeds and sugarcane farming, the rain also helps. Remember, the field crops are primarily rainfed. For example, only about 20% of maize, 15% of soybean, and 34% of sugarcane are produced under irrigation, leaving much of the crop dependent on natural rains.

Of course, there can be such a thing as too much rain. We already have some regions of South Africa that struggled to plant grain and oilseeds due to excessive rainfall. But the warmer weather between these rains has helped, and farmers were prepared to plant quickly whenever there is a window of sunshine and the fields are not too muddy.

We typically say the optimal planting window for summer grains and oilseeds in South Africa is between mid-October and mid-November in the eastern regions, and mid-November through to mid-December in the western regions. The area for these windows, amongst other things, was also a concern due to potential frost damage later in the season. There was always a need for farmers to plant at the right time to avoid the frost and take advantage of the rains earlier in the season.

But over time, we have seen seasons being far later than these windows. In fact, the 2024-25 season in grains and oilseeds, which brought an excellent harvest of 20.08 million tonnes (up 30% y/y), was delayed by roughly a month and a half from the typical schedule.

Therefore, even if the current rains delay plantings in some areas, there should be no significant concerns. We know from recent history that farmers can still plant quickly and enjoy a better season.

Overall, the current rains across South Africa are a welcome development for agriculture. The better agricultural conditions also mean a better path for food price inflation going into 2026.

So, for the inconvenience the rains cause you this summer holiday, you get a positive: moderate food price inflation in 2026.

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)