by Wandile Sihlobo | Nov 19, 2025 | Food Security

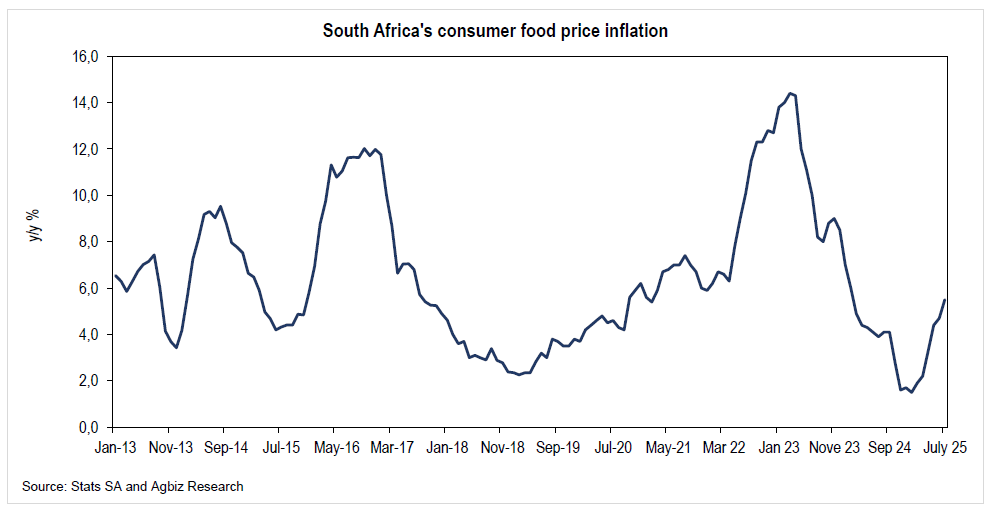

It is always comforting to receive data pointing to easing price pressures for consumers. On the food price inflation side, we are seeing some encouraging signs in South Africa, as the rate of food price increases is slowing.

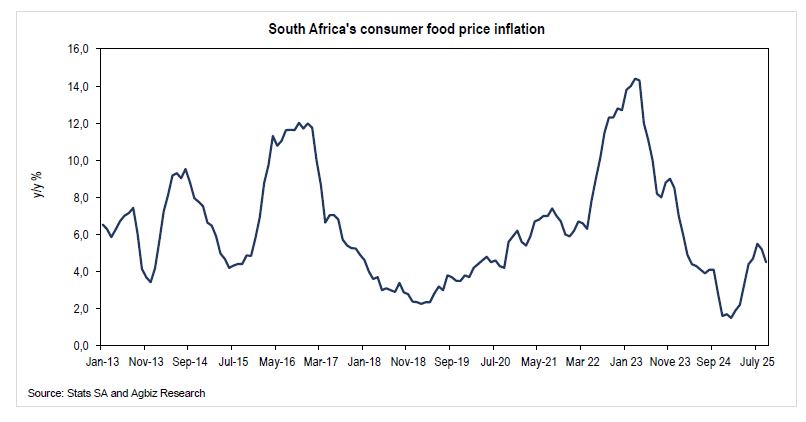

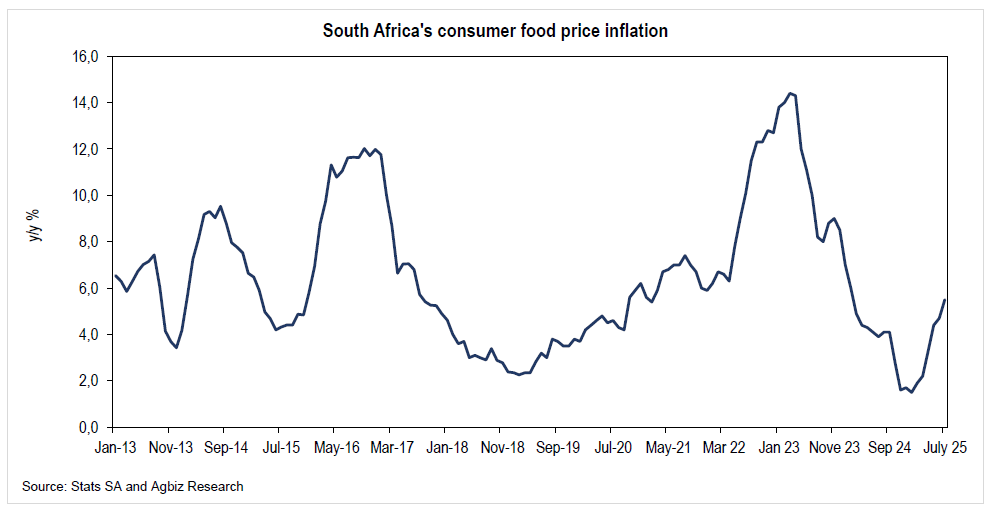

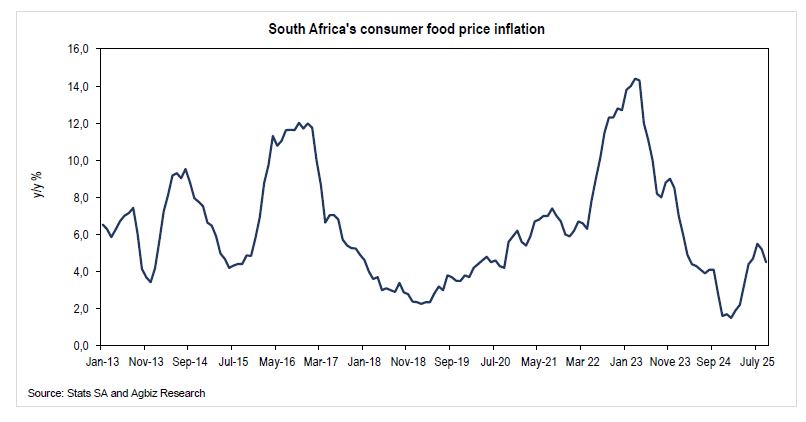

South Africa’s consumer food price inflation slowed for the third consecutive month, easing at 3.9% in October 2025, from 4.4% in the previous months.

The primary drivers of the deceleration were mainly fruit and nuts, vegetables, meat, sugar, confectionery and desserts. The ample supplies, combined with the base effects, are what contribute to the easing of price inflation in these products.

Moreover, while modestly up from the previous reading, the cereal products inflation also remains relatively low on the back of the ample grain harvest in the country.

The challenge of foot-and-mouth disease in South Africa is not over and continues to put pressure on farmers, even as vaccination is still underway.

Typically, during foot-and-mouth disease outbreaks, the country is temporarily closed to some export markets, leading to a drop in consumer prices.

But this year we saw the opposite. Initially, panic buying driven by retailers’ announcements, rather than a product shortage, was the main driver of meat prices, combined with buoyant consumer demand. We now see an easing of these upward price pressures.

Regarding the grains, South Africa has an abundant harvest, with the 2024-25 summer grains and oilseed harvest estimated at 20.08 million tonnes (up 30% y/y). The various fruits and vegetables also saw ample harvests.

From now on, we remain optimistic that South Africa’s consumer food price inflation will continue to moderate. The benefits of lower grain prices, ample fruit and vegetable supplies, and potentially easing meat prices will continue to be the major drivers of the deceleration.

Still, there is some uncertainty around meat, as foot-and-mouth disease remains a challenge.

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)

by Wandile Sihlobo | Nov 5, 2025 | Food Security

October 16th marks World Food Day, a celebration of the founding of the United Nations Food and Agriculture Organisation in 1945.

This day also provides an opportunity for countries to assess their food security conditions. Thus, this was one of the major discussion themes in South Africa’s agriculture last month.

At a national level, South Africa is considered food secure; however, this manifests differently at the household level, with many families still struggling with food insecurity.

Speaking in the Western Cape on October 17, President Cyril Ramaphosa also weighed in on the country’s household food insecurity challenge, correctly highlighting the household poverty challenges and emphasising the need to find ways of addressing the food insecurity crisis in the country.

Food insecurity has many different explanatory factors. Income poverty is one driver of household food insecurity in the country.

Moreover, the inefficient logistics and higher energy prices, amongst other factors that contribute to the cost structure of the economy, are sources of persistent cost pressure in the food value chain. These add upward pressure to food production costs, even in times of ample harvests.

Still, the fact that we have a robust agricultural sector, with surpluses, significantly helps boost food security at the national level.

Indeed, South Africa remains a conundrum, being both food secure at the national level and a net exporter of roughly half of its agricultural and food products annually in value terms.

Clearly, our household food insecurity challenges are not just an agricultural matter, but a challenge that requires a broader economic policy response. This is particularly true, as household food insecurity is primarily a challenge of inadequate household income to a large degree.

Therefore, ensuring the growth of the economy and job creation likely have a more notable impact in resolving our poverty challenges than simply focusing on agriculture per se.

This is not to negate the role agriculture can play. Indeed, the sector could play a positive role in creating jobs, specifically for the rural poor, where other sectors of the economy tend to be a lot smaller.

But the sector alone will not be able to change the South African household food insecurity challenge. Focusing on the reforms in the economy that stimulate growth in the various sectors, boost investments, and subsequently employment should be the key focus of policymakers.

It could be argued that South African households, although not experiencing food prices rising at a faster pace than in other countries globally, still pay reasonably higher prices for specific products. The underlying drive of costs in the food system, amongst other factors, is the value chain associated costs, as we stated above.

Therefore, observing only agricultural commodity prices as a signal for food prices is insufficient. Other notable food costs are associated with the processing and distribution of food products nationwide.

In addition to this, South African households spend a substantial portion of their wages on transport costs due to the deterioration of the public transport system. Therefore, public transport is another area that requires closer focus.

Another area of household spending, which we have not conducted in-depth research on, but requires closer examination, is the share of household spending on gambling activities. We are not attributing this factor to the rising household food insecurity in the country. Still, it warrants some attention given its growing prominence in the spending of South African households.

Ultimately, South Africa should address the constraints to growth, investment, and employment to alleviate the growing poverty.

The focus on agriculture is one aspect, but the policy response will need to be broader, focusing on strengthening income security, particularly for the most vulnerable households.

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)

by Wandile Sihlobo | Oct 22, 2025 | Food Security

We are finally beginning to see the benefits of the favourable agricultural season through the easing of South Africa’s consumer food price inflation. The data released by Statistics South Africa on October 22 shows that South Africa’s consumer food price inflation slowed for the second consecutive month, easing to 4.4% in September 2025, from 5.2% in the previous months.

The primary drivers of the deceleration were mainly fruit and nuts, vegetables, oils and fats, as well as milk and other dairy products. The price inflation of cereal products also remained relatively moderate, which illustrates the benefits of the ample harvest and the easing of grain prices at the farm level.

The same applies to the price inflation of fruits, nuts, and vegetables, which have declined notably in recent months due to ample supplies.

As with the previous month, a key product we are closely monitoring is meat, which has remained somewhat elevated, although slaughtering has resumed in major feedlots across the country.

Initially, panic buying, rather than a shortage of product, was the main driver of meat prices. Although the supply has improved slightly, prices remain elevated, illustrating that consumer demand may be somewhat more buoyant and able to contend with the current higher prices. There may also be a slight delay in price adjustments at the retail level.

Regarding the grains, South Africa has an abundant harvest, with the 2024-25 summer grains and oilseed harvest estimated at 19.94 million tonnes (up 28% y/y). The various fruits and vegetables also saw ample harvests.

Looking ahead, we remain optimistic that South Africa’s consumer food price inflation will continue to moderate. The lingering upside risk is the impact on meat prices, as the foot and mouth disease remains a challenge. The initial challenge with meat price inflation was the panic buying.

At the moment, slaughtering has now resumed in the major feedlots, although foot and mouth remains an issue. Usually, when there are outbreaks of disease, South Africa is temporarily restricted from various export markets, which, over time, increases the supply of red meat into the local market and adds downward pressure on meat price inflation. But this year has been different, partly because of the panic buying we saw earlier.

South Africa’s headline CPI was 3.4% in September 2025, from 3.3% in the previous month.

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)

by Wandile Sihlobo | Oct 17, 2025 | Food Security

The President delivered a vital speech today in Cape Town about food insecurity issues in South Africa. He correctly highlighted the household poverty challenges and emphasised the need to find numerous ways of addressing the food insecurity crisis in the country.

Income poverty (which requires an increase in job creation) is one aspect. Inefficient logistics and higher energy prices are among the pressures in the food value chain; thus, we remain with relatively higher food prices, even in times of ample harvests.

Still, the fact that we have a solid agricultural sector, with surpluses, helps a great deal in boosting food security at a NATIONAL LEVEL.

Moreover, another reason for household food insecurity is the low and stagnant growth, which contributes to unacceptable levels of unemployment. On top of this, South Africans spend a significant portion of their wages on transport costs due to the collapse of our public transport system. Ultimately, the country should deal with the constraints to growth, investment and employment.

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)

by Wandile Sihlobo | Oct 14, 2025 | Food Security

On October 14, the Business Day newspaper published a story where Shoprite, one of South Africa’s retailers, reminded us of the worsening level of poverty in the country. The organisation attributed the deteriorating poverty, in part, to the:

“deep challenges in food affordability and access, with consumers under severe pressure in the face of subdued economic growth and high unemployment.”

This picture is not very different from what Statistics South Africa also highlighted earlier this year. In February 2025, Statistics South Africa released the Food Security Report for 2019, 2022, and 2023 (COVID-19 affected the ability to collect data in 2020 and 2021). The report utilised data from the General Household Survey (GHS) for those years.

The report’s most striking observation was that:

“The proportion of households in South Africa that experienced moderate to severe food insecurity was estimated at 15.8% in 2019, 16.2% in 2022, and 19.7% in 2023. Over this period, the proportion of households that experienced severe food insecurity was estimated to be 6.4%, 7.5%, and 8.0%, respectively.”

I want to stress, however, that it appears the deteriorating food security is not due to a lack of nutritious, high-quality food and safe food products or high prices per se. Access seems to be the fundamental challenge, especially for households with no regular income sources.

Therefore, addressing income poverty at the household level must be the centre of any strategy to address food insecurity.

Clearly, while agriculture, the sector I work in, can play a role, this challenge requires coordinated efforts to grow the South African economy, lift employment across various sectors, and provide appropriate support to vulnerable households.

Despite the concerning trend in Stats SA’s survey, South Africa remains food secure and is a net exporter of agricultural products at the national level. Exports are necessary for sustaining farming incomes, generating the resources needed for investment, and ultimately, the sector’s ability to create and maintain jobs.

Notably, South Africa does not export its food supplies without appropriately considering the domestic food needs at the national level. Moreover, the country’s food prices remain relatively moderate. Despite this, food insecurity will remain a challenge if households have little to no income.

Agriculture will play its role where possible, and the path for agricultural growth has been studied and incorporated into policy thinking. For example, at a technical level, expanding agriculture and agro-processing capacity to boost growth and job creation was well established as far back as the National Development Plan 2012.

They were again highlighted in the 2019 National Treasury paper, in the 2022 Agriculture and Agro-processing Master Plan, and, most recently, in my book titled A Country of Two Agricultures: The Disparities, The Challenges, The Solutions.

Ultimately, South Africa’s agriculture plays a role in resolving household poverty challenges. However, the responsibility does not lie solely in the sector.

Other sectors of the economy can play an essential role in creating jobs and fiscal space, which can be used for various social causes to improve the quality of life in South Africa.

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)

by Wandile Sihlobo | Sep 17, 2025 | Food Security

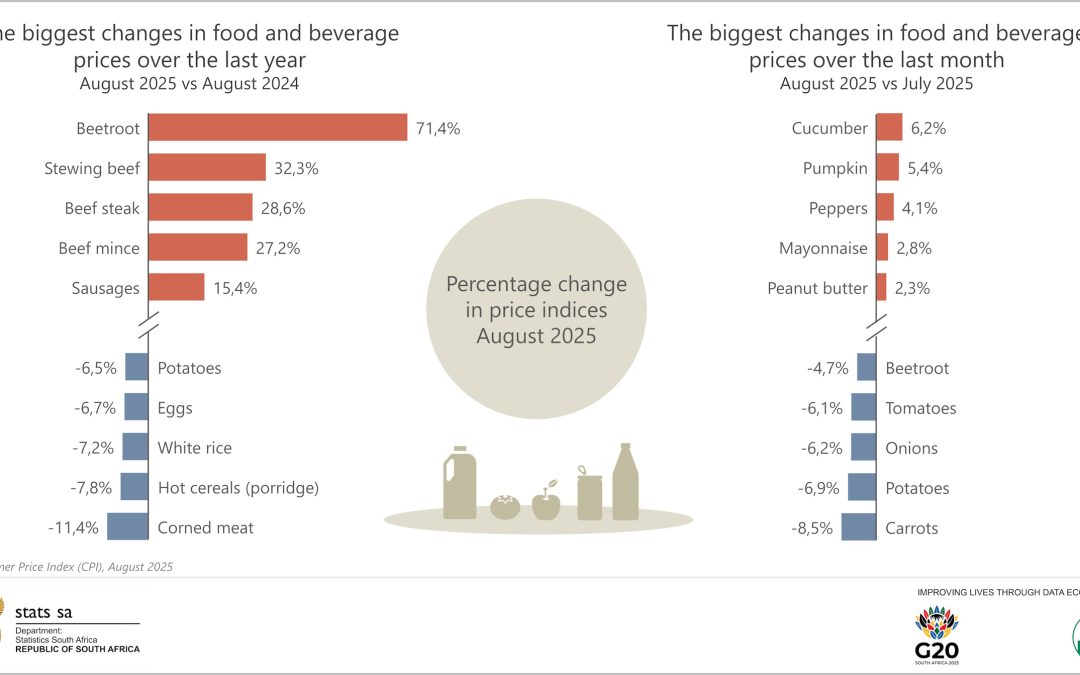

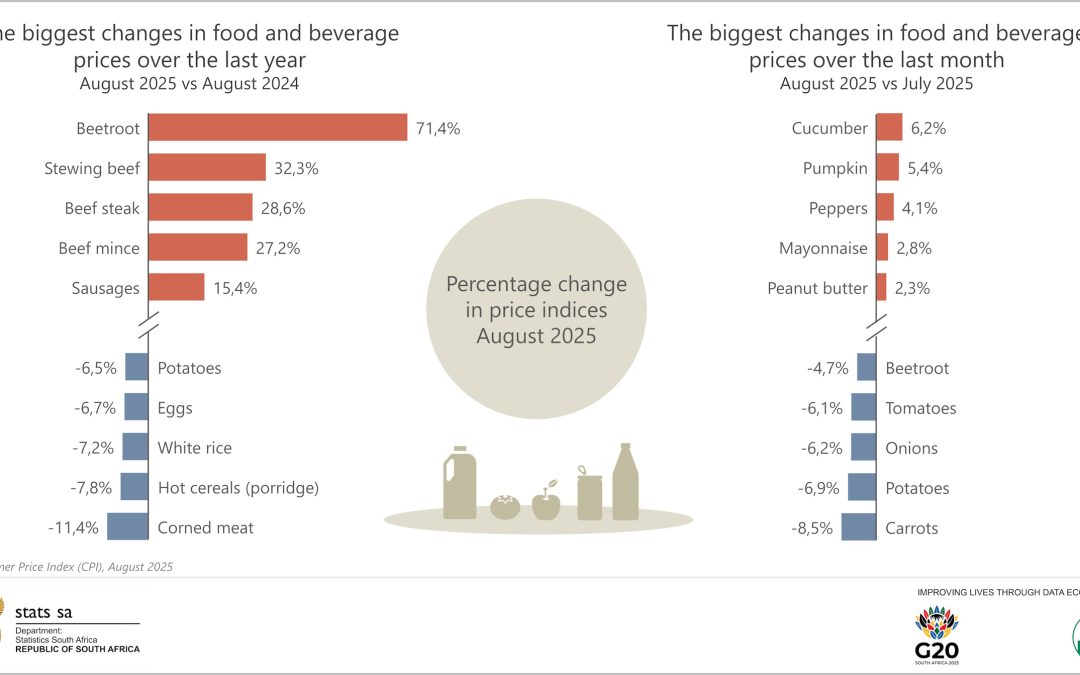

We see a constructive picture of South Africa’s food price inflation, easing at 5.2% in August 2025, from 5.5% in the previous months (the details are on this Stats SA chart). South Africa has an abundant harvest of grains, fruits, and various vegetables, and the benefits of this are starting to show in prices. It is these products that were the major drivers of the moderation in price inflation.

A key product that many are watching is meat, particularly beef (and red meat products), which has remained elevated, although slaughtering has resumed in major feedlots across the country. The issue is that South Africa is experiencing a foot and mouth disease outbreak.

Initially, the panic buying, not necessarily a shortage of product, was the main driver of meat prices. This is when the country’s largest feedlot announced the cases in its facility. This led to concerns about red meat supplies and some panic buying, thus pushing up prices. The slaughtering has now resumed in the major feedlots, although foot and mouth remains a profound challenge in the country.

We must also remember that when there are outbreaks of disease, South Africa is temporarily restricted from various export markets, which, over time, increases the supply of red meat into the local market.

This all sounds encouraging for a consumer, but the red meat producers in South Africa are under enormous financial pressure. This has been a challenging year.

From a consumer perspective, we anticipate the red meat picture (prices) will ease in the coming months. We are already seeing better prices at the farm level. This, together with better grain prices, all point to a potentially moderating food price inflation for the coming months.

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)

by Wandile Sihlobo | Aug 20, 2025 | Food Security

In yesterday’s letter, I stated my view on South Africa’s food price inflation prospects, signalling a possible moderation. But as the close observers of the data have seen, we have continued to observe a faster rate of increase in South Africa’s consumer food prices.

The data released on August 20 by Statistics South Africa shows that the consumer food price inflation rose to the highest level in 18 months, at 5.5% in July 2025, from 4,7% in June, underpinned primarily by the continuous increases in the meat and vegetables prices.

So, doesn’t this mean we are changing our view about the path ahead? No, we believe the major drivers of these particular products are temporary. Thus, we have maintained our view of potentially moderating food price inflation in the coming months.

As with the previous month, the increase in the meat price inflation was due to two significant factors, which have now somewhat eased.

First, the outbreak of avian influenza in Brazil led to South Africa temporarily restricting the imports of poultry products from Brazil, causing panic in the market. However, the restrictions have now been lifted, and imports are slowly recovering.

Second, South Africa experienced an outbreak of foot-and-mouth disease, which led to concerns about red meat supplies and some panic buying, thus temporarily pushing up prices. The slaughtering has now resumed in the major feedlots, and we continue to believe we may see easing in red meat prices, which should be reflected in the inflation figures of the coming months.

Moreover, when there are outbreaks of disease, South Africa is temporarily restricted from various export markets, which, over time, increases the supply of red meat into the local market.

About vegetables, the price increases are primarily because of the excessive rain’s impact on products, as we have seen volumes of certain products down somewhat in various Fresh Produce Markets in the past couple of months. But the recent data are showing an improvement, which again underscores our view that the recent price inflation acceleration may be temporary.

In essence, while food price inflation accelerated in July, we expect some moderation in the coming months, as the prices of the above products potentially slow, and we see the continuous benefits of an ample domestic grains harvest and a decent fruit harvest that continue to enter the market.

South Africa’s headline CPI was 3.5% in July 2025, from 3.0% in the previous month.

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)

by Wandile Sihlobo | Aug 19, 2025 | Food Security

We have inflation data for July out later this morning, and I will be looking closely at the food category. Last month, South Africa’s consumer food price inflation rose to the highest level in 16 months, at 4.7% in June 2025, from 4,4% in May, underpinned mainly by the recent increases in the meat, oils and fats, and vegetables prices.

Commenting after the release of these figures, I noted that the acceleration does not alter our assessment of moderate food price inflation in 2025. I still maintain this view, although there are a few items worth monitoring closely, such as meat and vegetables.

In the case of meat, there remains room for potential upside on price inflation, but this will be temporary.

The key factors to consider are that, at the start of the year, consumer demand was improving, and abattoirs capitalised on this improvement by raising prices. This continued for some time.

Moreover, there was panic buying after the announcement of the foot and mouth disease. We also temporarily blocked Brazil’s poultry imports due to an outbreak of avian influenza.

But these fundamentals have shifted. The slaughtering has resumed in some major feedlots that were affected by foot-and-mouth disease. Again, when we have foot and mouth disease, our exports are blocked temporarily, leading to an increase in the domestic meat supply.

In the case of poultry, the ban on Brazil’s poultry imports has been lifted. This is all to say, if we see meat elevated, we will know when the data is out, it may be the tail-end effects of these issues.

In the case of the vegetables, the weather impact affected the supplies a bit in some areas. But if one has been observing volumes in various Fresh Produce Markets, things are normalising well.

Another product that saw an increase in June was oils and fats, primarily linked to increases in the global vegetable market, partly because of the strong global demand for palm oil. We expect the decent local sunflower seed crop to help ease any concerns about supplies in the local market in the coming months.

On the positive side for the consumer, many of the above factors may be temporary. Importantly, we have ample domestic summer grain and oilseeds, and a good fruit harvest, all of which bode well for moderating food price inflation. It is on this basis that last month, I signalled an optimistic view of moderating food price inflation in 2025.

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)