by Wandile Sihlobo | Aug 27, 2025 | Agricultural Production

In two months, farmers across South Africa will begin tilling the land for the 2025-26 summer grain and oilseed season. However, for now, we still have our eyes on the 2024-25 season, which is nearing its end.

This afternoon, on August 27, South Africa’s Crop Estimates Committee increased the country’s 2024-25 summer grains and oilseeds production estimate by 4% from last month, to 19.55 million tonnes.

This estimate comprises maize, sunflower seeds, soybeans, groundnuts (peanuts), sorghum, and dry beans. There is an annual uptick in all the crops, mainly supported by favourable summer rains and the decent area plantings. The base effects also help, as we struggled with a drought last year that weighed on the harvest.

This ample crop will likely continue to put downward pressure on prices, which bodes well for a moderating path of consumer food price inflation.

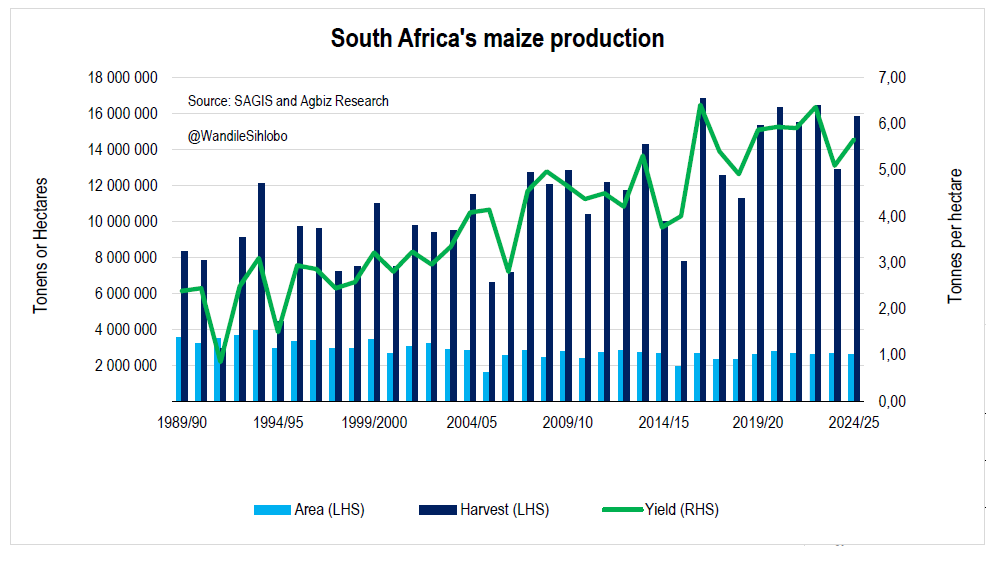

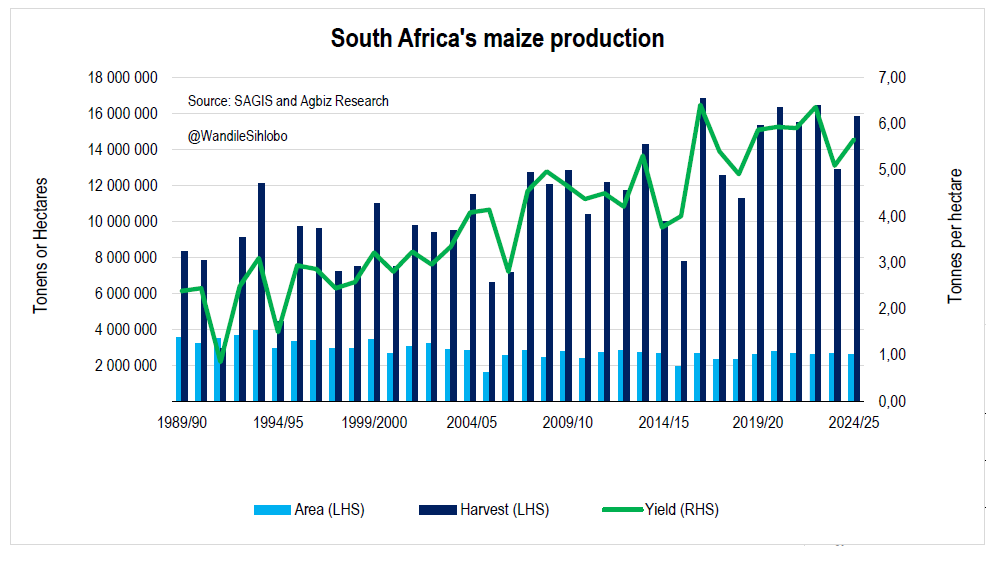

If I were to highlight one crop to underscore my point about food inflation, it would be maize. South Africa’s 2024-25 maize harvest is now forecast at 15.80 million tonnes, which is 23% higher than the 2023-24 season’s crop.

Importantly, these forecasts are well above South Africa’s annual maize needs of approximately 12.00 million tonnes, implying that South Africa will have a surplus and remain a net exporter of maize.

In essence, we are in another year of abundance in grain production, despite the quality issues in the white maize and sunflower seed regions.

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)

by Wandile Sihlobo | Aug 26, 2025 | Agricultural Environment and Natural Resource

It is easy to take for granted the gains we have achieved in South Africa’s agriculture, and for some, not to recognise that the very interventions from many organisations, especially those related to agrochemical use and advancement in breeding, have helped deliver this progress.

Some of the aspects one often sees are calls for restrictions on certain agrochemicals or slow progress in registering new agrochemicals by regulators.

The safety of agrochemical use is vital, and the optimal use while taking care of the environment is also key. This is what the discussion should be about, urging farmers to continue with safety practices and to avoid excessive use of any input.

However, the outright calls for restrictions on some inputs are typically misguided, and some compare our practices with those in Europe or other regions without appreciating that any input use is partly dependent on the environment in which we operate and the diseases or deficiencies we face.

On matters of products, we can’t always apply what happens in different geographies here. The key obsession for us in South Africa should be an embrace of science to improve our agricultural output and productivity, while ensuring safety and optimal use of inputs.

The regulators must also share the same objective: to embrace science and ensure that South Africa remains at the forefront of agricultural progress.

We are where we are today, the leading agricultural exporter in Africa, in part because of scientific advancements and their adoption.

We are a semi-arid country, and we are witnessing an increasing number of disease outbreaks in crops and animals. One way of adapting will be through an embrace of science. We cannot hesitate on such important aspects for our food security and the progress of our rural economy.

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)

by Wandile Sihlobo | Aug 26, 2025 | Agricultural Environment and Natural Resource

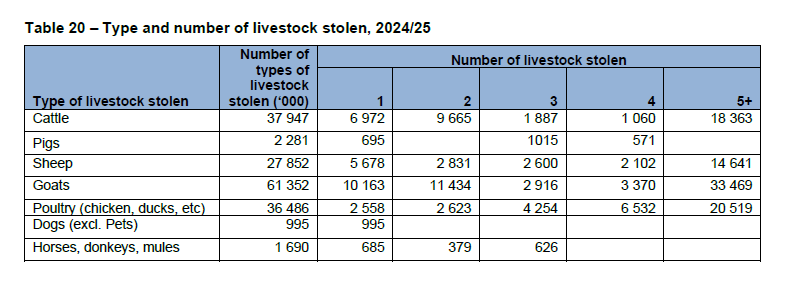

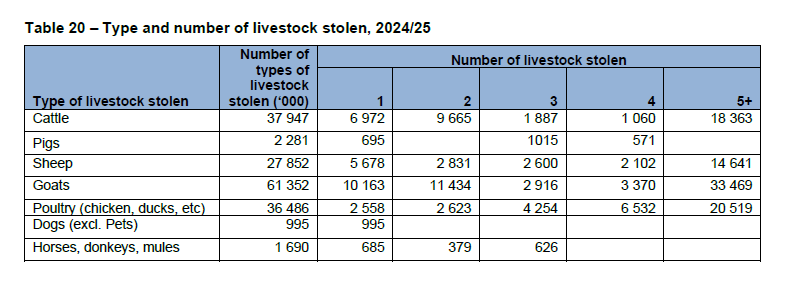

The one issue I haven’t written about, but is increasingly a challenge in some areas, is stock theft and crop and fruit theft. The data on some of these issues is scant, but I was reminded of this this morning when Statistics South Africa released its Governance, Public Safety, and Justice Survey results. In the agricultural section, Statistics South Africa indicated that in 2024/25, there were over 61,000 goats stolen, followed by cattle (37,947), then poultry (36,486).

Statistics South Africa also provided a valuable table below, which illustrates the locations where theft of livestock occurred and the type of livestock that was stolen in 2024/25.

We can see here that nearly half of the incidences occurred in a kraal/outside the house, followed by when livestock is in the fields/grazing land (40,7%).

In terms of what the thieves are after, we can see that the goats (39,8%) were the most common livestock that was stolen, followed by cattle (24,6%) in 2024/25.

If we want to continue having a prosperous agricultural sector, we must put strong control on these issues. This could be through enhanced collaboration between the police services and organised agriculture groups.

The theft indecencies present enormous costs to farmers and agribusinesses. In fact, if one talks to any commercial farmer, they would learn that over time, there is significant spending on security. I have seen several farmers installing cameras and several security measures due to concerns about crime.

For new entrant farmers, who may also have a relatively weak financial muscle, stock theft may take some out of business. The same is true for smallholder farmers who are also victims of such crimes, leaving households in a worse-off position.

Indeed, crime and theft are not unique to South Africa. We have seen cases of avocado theft in Mexico and other regions of the world. In New Zealand, they have also struggled with similar issues of avocado theft. The response in these countries has generally been enhanced collaboration between farmers and police services. It is such a response that we must also see in South Africa, at a much-improved level than we currently see.

We must also not forget that South Africa continues to view agriculture as one of the key sectors to our long-term growth agenda. To achieve the long-term growth objectives, we not only need the release of over two million hectares of government land to farmers with title deeds, but also an increase in investment. The investment will increase if there is comfort about the security in our sector. Thus, issues of crime must also be prioritised and addressed swiftly.

We are also at a space where we, as a country, are encouraging young people to join the sector. For the young and new entrant farmers to thrive and have confidence in the sector, there must be a security improvement. Therefore, fighting crime should remain a top priority in collaboration with organised agriculture.

Again, we are only talking about livestock here, but we know of incidents of crop and fruit theft in some regions of the country, which also requires serious attention.

Agriculture is an essential sector of our economy, with great potential for job creation and improvement of economic conditions in rural South Africa; therefore, ensuring that farmers are operating in a safe and sound environment is key.

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)

by Wandile Sihlobo | Aug 25, 2025 | Agricultural Production

Tomorrow, August 27, South Africa’s Crop Estimate Committee will release its first production estimate for the 2025-26 winter crop season. The season has generally been fair, with favourable rainfall in much of the Western Cape, a province that accounts for more than two-thirds of South Africa’s winter crops.

In other provinces, the winter crops are mainly produced under irrigation, and the favourable summer rains helped to improve the dam levels, enabling irrigation.

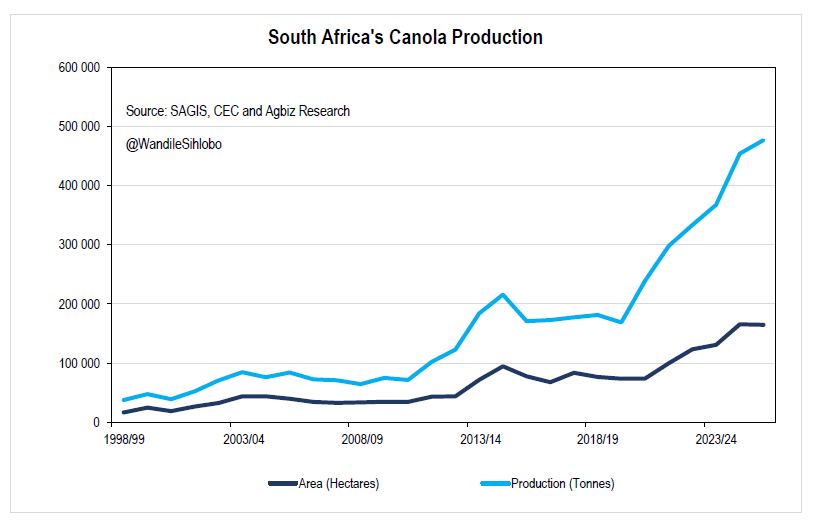

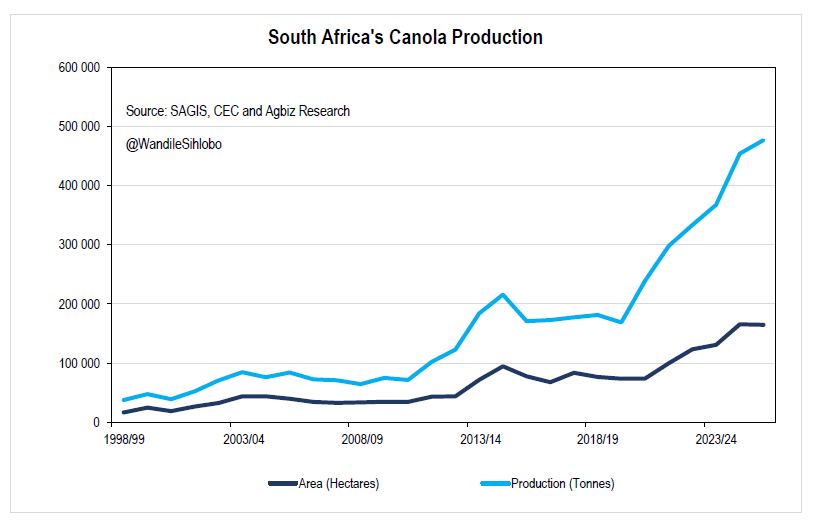

One of the crops I will be watching closely is canola. While for farmers in some regions of the Western Cape, canola may not be as profitable this year because of higher input costs, it could reach a new record level in terms of output.

The big challenge for farmers in some areas of the Western Cape this year was the infestation of snails in the early stages of the season, forcing farmers to replant the crop, thus increasing the input costs.

Currently, we know that farmers planted 164,900 hectares, down 0.5% from the previous season. This area may also be revised when we receive the new data tomorrow.

But if we assume that it holds, the relatively favourable weather conditions could still bring a bigger crop than the last season. For example, if we apply a five-year average yield of 1.89 tonnes per hectare on the area of 164,900 hectares, South Africa could harvest 311,661 tonnes of canola, representing an 8% increase from the previous season.

This would be a fresh record, reinforcing South Africa’s position as a relatively new exporter of canola products. South Africa is now a net canola exporter, having recently exported to countries such as Germany and Belgium.

As I have written recently, canola is a relatively new crop in South Africa, but it remains a success story. Since South African farmers planted the crop commercially on 17,000 hectares in 1998-99, the area has increased to an estimated 164,900 hectares in the 2025-26 season.

Over the years, the catalyst behind the increase in canola plantings has been a rise in domestic demand or usage for oils and oilcake.

There has been a switch from traditional winter wheat and barley growing areas to canola because of the firm demand and the price competitiveness. Canola is a winter crop, principally planted in the Western Cape, a winter rainfall region in South Africa.

Anyways, we will know more tomorrow where things are, but I wanted to put it out that I remain an optimist.

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)

by Wandile Sihlobo | Aug 25, 2025 | Agricultural Environment and Natural Resource

As someone who spends a bit of time thinking about agricultural development and efficiency gains among existing commercial farmers, it is always encouraging to encounter new organisations that are focused on this goal.

Earlier today, I made a brief stop at Khula!, an agri-tech company based in Johannesburg. This was not my first engagement with Khula; I had engaged with the team deeply in the early stages of their work.

But after some years, it was refreshing to listen to their team talk about the various offerings to support farmers and the improvements they make in the efficiencies in the different value chains of our sector. Khula’s work on farm inputs provision, commodities and fresh produce trading, and off-taking of the produce, amongst other things, is all essential to the agricultural industry.

Importantly, they are not only assisting small-scale or exclusively large-scale farmers; their product offering is valuable for all types of farmers. They also cover most commodities, and do not only focus on one subsector.

This is not a sponsored post; I don’t do those. But I felt it was important that I highlight Khula in case some people who read these letters are not aware of young entities like Khula, which are already making great strides.

Khula’s leadership is young and vibrant, and it was very inspiring to listen to them and hear their vision and enthusiasm about South Africa’s agriculture and the entire food, fibre, and beverages value chains.

Of course, the agri-tech companies cannot stand on their own; they are the service providers, which means their growth depends on the support of the various stakeholders. Equally, the various sector stakeholders could realise some efficiency gains when bringing in or collaborating with various agri-tech organisations.

The success of the South African agricultural sector is reliant on the efforts of many organisations and individuals, including scientists, breeders, seed companies, machinery suppliers, financiers, input suppliers, agribusinesses, traders, and many more valuable organisations and service providers.

The agri-tech new firms add to this line of organisations that sustain this critical sector of our economy that we all take pride in, which has more than doubled since 1994 in value, with exports at nearly US$14 billion a year, and made South Africa the only African country in the top-40 global agricultural exporters.

I have mentioned Khula here, but we have many other young agri-tech companies in South Africa, such as OneFarm Share, AgrigateOne, Nile, and Agrimall, among others. I know I have skipped a few (apologies).

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)

by Wandile Sihlobo | Aug 24, 2025 | Agricultural Trade

The access to the various export markets that some SA industries enjoy now is the result of the efforts of the past two decades. What is critical for the sustained success of our export markets is the initiatives we take now in the changing global trading system to secure constant access, and to open more avenues.

Regarding the agricultural sector, in the early 2000s we exported about $2bn worth of products. From the mid-2000s to the 2010s we managed to secure more export markets and SA’s agricultural exports gained momentum. In 2018 SA’s agricultural exports crossed the $10bn mark, and have remained robust since.

With the steady export activity, farmers responded positively by continuously improving the productivity and quality of the produce. The export efforts came from the private sector, organised agriculture, academia and the government, among other key stakeholders. It is due to such effective collaboration that SA’s farming sector is now the 32nd largest exporter globally in value terms, and the only African country among the top 40 of global agricultural exporters.

These exports were at a record $13.7bn in 2024. The success of opening these markets also came amid embracing globalisation. We are now at a different time, in which fragmentation is the theme.

At the weekend I looked at how SA’s agricultural export activity is progressing so far this year. In the doom and gloom of the day on trade matters, SA’s agricultural export figures remain encouraging. After solid export activity in the first quarter of the year, SA’s agricultural exports totalled $3.71bn in the second quarter of 2025, up 10% from the same period in 2024. This is a function of higher volumes of various product exports and better commodity prices.

The products that dominated the exports list in the second quarter of the year were mainly citrus, apples and pears, maize, wine, nuts, fruit juices, dates, pineapples, avocados, grapes and wool. While there remains a need for further improvement in the efficiency of the ports, there has been a material improvement compared with recent years. Agricultural export activity in the second quarter experienced less friction than in the recent past.

SA has been generally successful in securing access to diverse export markets, gaining greater access to the African continent, the EU, Asia, the Middle-East and the Americas, among other regions. Consider the $3.71bn in agricultural exports in the second quarter, about 40% of which was to the African continent. Trailing Africa was the EU, with a 22% share in the exports. About 21% went to the Middle East and Asia, with 7% share being the Americas. The remaining 10% was the rest of the world, including the UK.

The struggle now is about retaining these markets. They each face a range of pressures from countries that want to diversify their exports after the US trade tariffs and the changing global trade landscape. The effort of maintaining these markets must again be rooted in the collaboration of business, organised agriculture, academia and the government, among other stakeholders.

We also have to review the capacity of all stakeholders on trade matters consistently; we no longer have the teams we had in the early 2000s in some departments. Therefore, part of strategising about export diversification involved capacity rebuilding and a shift in mindset towards embracing free trade agreements. The work on all this must start now.

Written for and first appeared in the Business Day.

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)

by Wandile Sihlobo | Aug 22, 2025 | Agricultural Trade

We continue to see encouraging momentum in South Africa’s maize exports. The efficiency at various ports is improving this year, after the challenges of recent years.

Our maize exports are also recovering in the various regions of the world. Last year, we exported a lot to the African continent, which faced low production because of the drought. This year, we are resuming our exports in the Far East and various parts of the world.

One country that has shown up in our maize export list for three consecutive weeks is Venezuela. I am again mentioning them, not that Venezuela is a lucrative market, but the point is that we are back in export markets beyond the continent in the maize industry. We all know the challenges of the Venezuelan economy.

I’m looking at South Africa’s weekly maize exports data, and Venezuela imported 32,999 tonnes of South African white maize variety in the week of 15 August 2025 (following a consignment of 15,134 tonnes in the previous week).

The last time Venezuela was in our maize export list with a decent maize purchase before reappearing this year was in 2018, with about 31,500 tonnes of maize imports. So far this year, Venezuela imported 65,999 tonnes of white maize variety.

Anyways, I wanted to highlight in this post that South Africa exported 44,093 tonnes of maize in the week of 15 August 2025. About 74% was exported to Venezuela, and the rest to the Southern African region.

This placed South Africa’s 2025-26 maize exports at 535,866 tonnes, out of the expected seasonal exports of 2.12 million tonnes. The current marketing year only ends in April 2026. We will likely see more robust export activity later in the year as the demand increases in other regions of the world.

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)