by Wandile Sihlobo | Sep 15, 2025 | Agricultural Production

The South African livestock and poultry industry faces various challenges that include animal disease and stock theft, among other issues. The one positive development in recent months has been the notable decline in the feed prices.

I was looking at yellow maize prices for today, September 15, and they remain at a level around R3,600 per tonne, which is roughly 7% down from a year ago. Soybeans, another key input in feed, are priced around R7,300 per tonne, which is down approximately 13% from a year ago.

The decline in prices mirrors the improvement in the domestic harvest in the 2024-25 production season. We may likely have entered a period of reasonably affordable feed prices. The early views about the 2025-26 agricultural season, which starts next month, October, also point to optimism and possible favourable rainfall.

Such a season would naturally deliver a better harvest, keeping feed prices in check for some time. Of course, it is too early to tell. However, I believe it is essential to highlight at least one point of optimism regarding the input costs for the livestock and poultry industries in South Africa.

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)

by Wandile Sihlobo | Sep 14, 2025 | Agricultural Trade

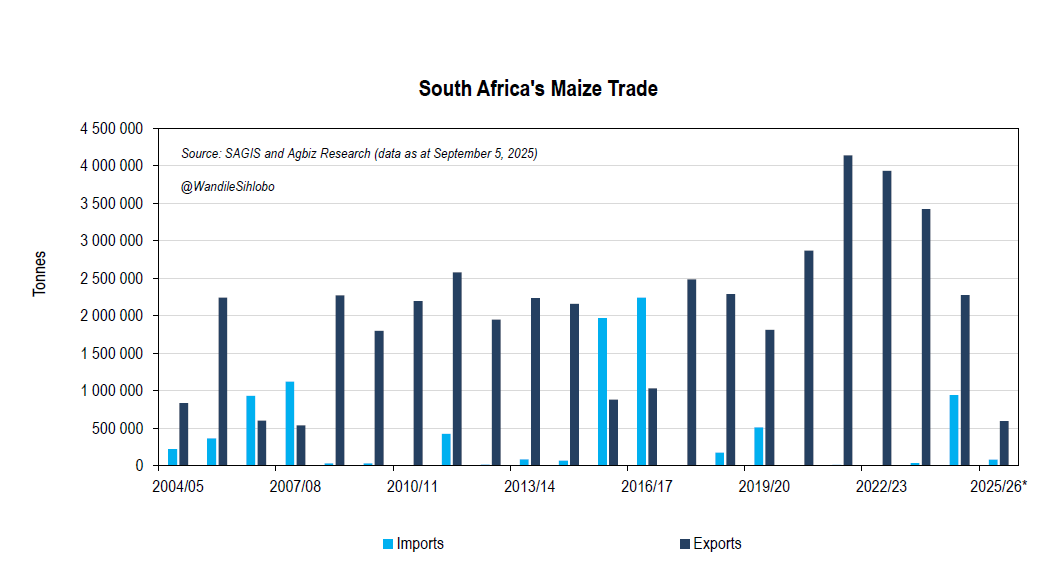

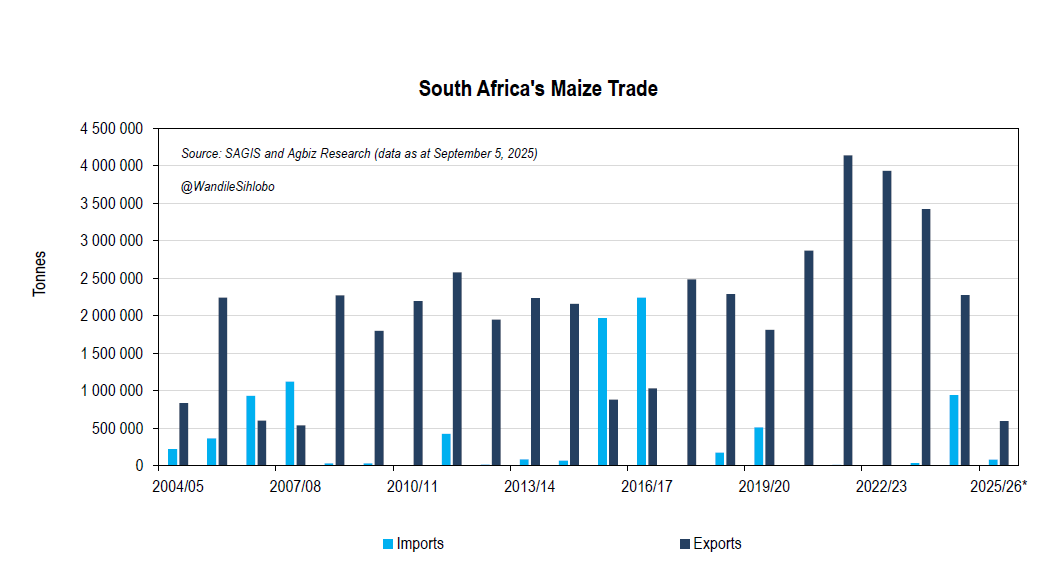

One thing that probably requires some clarification with South Africa’s maize trade at the moment is that we haven’t necessarily stopped imports. Yes, imports. But this does not mean we have shortages per se.

South Africa has one of the best agricultural seasons, albeit with some quality issues with white maize. The volumes are solid.

However, the livestock and poultry producers in coastal regions of South Africa sometimes compare feed prices here at home and elsewhere in the world, and take advantage of relatively lower prices from other origins. But such opportunistic yellow maize imports happen rarely in seasons of abundance like this one.

I am raising this issue because those who closely examine our maize trade data will notice that, to date in the 2025-26 marketing year (corresponding to the 2024-25 production season), South Africa has imported 77,768 tonnes of yellow maize from Argentina. These are opportunistic imports and don’t necessarily mean that we experienced some shortages. The yellow maize is likely for animal feed production, as has been the case in the past.

As all this is happening, the exports from South Africa to the various destinations in the world also continue. For example, in the week of September 5, South Africa exported 23,811 tonnes of maize, all to the Southern African region. This placed South Africa’s 2025-26 maize exports at 592,994 tonnes, out of the expected seasonal exports of 2.12 million tonnes. The current marketing year only ends in April 2026. About 60% of South Africa’s maize exports so far are yellow maize.

The various regions South Africa has exported maize to this year, aside from the broader African continent, include Taiwan, Sri Lanka, Vietnam, South Korea and Venezuela. We will likely see continuous exports to these regions. We are not even at half of South Africa’s maize export season for the year, which is 2.12 million tonnes.

The next couple of months may likely be quiet, particularly in the Southern Africa region, as some countries rely on the recently harvested domestic supplies for now.

We will likely see more robust export activity later in the year once farmers have completed the harvest and there is grain in the silos for export. This is also a time when we anticipate that countries like Zimbabwe, which currently have an import ban on maize, will return to the market to buy some South African maize to fulfil their domestic needs.

South Africa has a robust maize production season. The 2024-25 maize harvest is estimated at 15.80 million tonnes, a 23% increase year-on-year, primarily due to expected annual yield improvements. This harvest is well above the long-term production levels in South Africa.

Importantly, these forecasts are well above South Africa’s yearly maize needs of approximately 12.00 million tonnes, implying that South Africa will have a surplus and remain a net exporter of maize.

Therefore, when one hears about yellow maize imports, this is a vital context that one must remember. We are not experiencing any challenges with domestic maize supplies or higher domestic prices.

Important: South Africa’s maize prices have declined notably over time as a result of ample domestic harvest. At the end of the week of September 12, 2025, South Africa’s white maize spot price was down roughly 28% from a year ago, trading under R4,000 a tonne. At the same time, South Africa’s yellow maize spot price was down by 7% from a year ago, trading at levels around R3,600 per tonne.

Therefore, the imports are primarily opportunistic, not because South Africa’s maize is expensive per se. We also expect them to be limited, as the domestic harvest is abundant.

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)

by Wandile Sihlobo | Sep 11, 2025 | Agricultural Environment and Natural Resource

We are in Adelaide today, and we spent much of our time at the University of Adelaide, engaging with academics and researchers in agriculture, agribusiness, and international trade matters.

On the agribusiness aspect, we met with researchers at the Global Food and Agriculture Research Centre (GFAR), and today’s discussion had a different feel, as we were talking with researchers whose work is mainly focused on matters outside Australia. They cover the issues of agricultural development in the Pacific region and Asia. The farmer development activities and value chain research in several of these regions closely resemble what is needed in certain areas of the African continent.

Indeed, South Africa’s agriculture is quite advanced. On the smallholding segment of our farming economy, we have pathways of supporting them, such as the Agriculture and Agro-processing Master Plan, amongst other domestic strategies. But when considering the African continent, there remains room for improvement in agricultural productivity and progress.

Research by University of Adelaide colleagues in the Pacific region and certain regions of Asia provides valuable insights relevant to such cases.

On international trade, our conversation focused, amongst other things, on the changing global trade patterns by various countries in South-East Asia and the Pacific region. This is of particular interest to us in South Africa as we are also embarking on export diversification for a range of our sectors.

The effort is motivated not only by our challenges in the U.S. market, but also by a general growth path. Therefore, hearing what other countries are doing has been empowering.

One of the key observations that emerges is that many countries are looking at export diversification, and targeting relatively the same regions as key markets, mainly the Middle East, China and India, amongst other economies. This means that competitions in these markets may be even more challenging for us as we also look into these markets as potential export diversification regions. Again, what also matters in such issues are the various export strategies of specific product markets.

The core insight is that there is much more to learn and collaborate on with institutions here in Australia and elsewhere as we continue to build resilient economies.

11 September 2025

Adelaide, Australia

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)

by Wandile Sihlobo | Sep 10, 2025 | Agricultural Environment and Natural Resource

We are in Canberra today, Australia’s capital and a great city. Amongst many vital engagements we had, we also managed to meet colleagues from the Department of Agriculture, Fisheries and Forestry (DAFF).

I was not a stranger to their work, as we in South Africa closely follow the agricultural policy and crop forecasting developments in Australia, partly due to their significant role in global grains production and exports, as well as the similarities in production conditions with South Africa.

To demonstrate the relevance of this letter, I will highlight several key aspects of their work, including climate-smart agricultural practices, biosecurity, collaboration with the private sector on research, in-depth insights into agricultural trade, and commodity forecasting. These are all the areas that apply to South Africa’s agriculture.

The DAFF equips farmers with sound research and pathways in reducing emissions and producing in more environmentally friendly ways. These are aspects that are also vital for global agricultural trade in today’s environment. Australia exports over two-thirds of its agricultural produce; therefore, compliance with the requirements of its key markets remains vital.

Like Australia, South Africa is an export-oriented agricultural sector, although smaller in value terms (and roughly half of our agricultural products go to exports). The practices of supporting various climate-smart agricultural research, improving biosecurity, and deepening trade research are areas where South Africa should increase its focus.

Fortunately, some of these matters are not far from our discussions at home. South Africa’s Agriculture and Agro-processing Master Plan already has some elements of such work.

What remains missing is the focus on implementing the plan, along with the release of the 2.5 million hectares of government-owned land with title deeds, which could be key for inclusive growth. The biosecurity matter, which I discussed in my first letter, remains a running theme, but not just about animal health; it is also key for plant health.

I mentioned the Master Plan because of its structure, which involves government and private sector participation. This is a strength of the Australian approach to agriculture, which we must focus on at home, and ensure there are resources and implementation in the many plans we have crafted.

I won’t delve into much, but I hope this provides a high-level view of agricultural matters.

10 September 2025

Canberra, Australia

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)

by Wandile Sihlobo | Sep 9, 2025 | Agricultural Environment and Natural Resource

We spent the day in Wagga Wagga in south-eastern Australia, visiting experimental farms at Charles Sturt University’s AGRIPARK. They are doing industry-focused research on various value chains, including livestock, wine, grains, and horticulture. The focus of their work primarily responds to the needs of the industry, which helps with the application of the results.

The research’s funding model has some similarities with that of South Africa. The farmers pay a certain amount of levies (as a percentage of the value or volume of their production). We see this in some commodities in South Africa. However, in Australia, the government ensures that every dollar raised by farmers matches the amount raised by farmers. The objective is to continuously boost Australia’s agricultural productivity and strengthen the country’s standing in global food production and trade.

Once the funds are raised, the government and industry share ideas on the research areas and build a common understanding of priorities.

In South Africa, we see agriculture as a sector that could drive our rural economic growth and job creation. This approach of research co-funding and permitting the industry to have a notable say on research priorities would benefit our objectives.

Indeed, unlike Australia, we remain “A Country of Two Agricultures”; therefore, some consideration must be given to issues of inclusivity. Still, the co-funded research would be of benefit to both of these Two Agricultures.

Beyond funding matters, there is considerable scope for South Africa and Australia’s agriculture to collaborate, particularly on issues of digitalisation, biosecurity, and climate-smart agricultural practices. There are advancements in these areas in South Africa that Australian farmers can learn from, and equally for us.

Our countries have similar climate and agricultural production conditions, and face roughly the same issues in global agriculture. This means that, through commodity associations in South Africa and the Department of Agriculture, we may need to explore additional ways to facilitate regular engagement.

9 September 2025

Wagga Wagga, Australia

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)

by Wandile Sihlobo | Sep 8, 2025 | Agricultural Environment and Natural Resource

It is late afternoon on a Monday (September 8) in Sydney, and I am ending another beautifully sunny day, which has also been quite productive. We had the opportunity to engage with the meat and livestock industry, grain growers, and academic researchers, and concluded the day by meeting with Horticulture Innovation Australia.

What is clear from all our interactions is that there is room for collaboration between South Africa and Australia’s agricultural sectors. From all our interactions today, it was clear that most stakeholders are aware of South Africa’s farming advancements and its contribution to the global food, fibre, and beverages trade.

The same is true in South Africa; we look at Australia with a great appreciation of their contribution to global meat and livestock, wine, wheat, horticulture and other products.

Oftentimes, it may be easy to view each other as competitors, particularly since we produce in the same season, and can look at roughly the same export markets for some products.

Still, I would argue that there is much room for collaboration and complementarity. If one considers the wheat industry, for example, South Africa is working on boosting its production, but over the foreseeable future, it will likely remain a net importer. Our imports are generally around 1.8 million tonnes a year. Australia is one of the key high-quality wheat producers that could continue to supply the South African market.

Similarly, with rice, we don’t produce any, and Australia could, over time, join the likes of India and Thailand in experiencing the million tonnes of annual rice imports in South Africa.

Importantly, this does not need to be one-way and should not primarily focus on trade. The most promising area for collaboration between the two countries could be in research-related matters. Listening to the various industries today and academic colleagues speak about their current focus on research and innovation, it is clear that we can lean on some of their work, particularly because of the similarities in our environments. The work Australia is doing on plant health and seed breeding in various commodities is particularly key to our agricultural efforts in South Africa.

In the livestock industry, Australia has advanced in biosecurity and surveillance, another area of potential collaboration. Admittedly, the fact that the country is an island provides it with a buffer from the various diseases in a way that South Africa is unable to be shielded. Still, the rigorous biosecurity practices are something that we can learn from and implement in our work at home.

On the academic level, there are already various collaborations between some Australian universities and South African ones on agricultural matters, particularly on poultry and nutrition research. This knowledge sharing and partnership are key to strengthening our farming sectors and enhancing the relationship between the two countries.

There is also a lot more we could learn about the agricultural research funding approach in Australia. Both the government and industry contribute financial resources to research, and industry has a notable say on what areas should be prioritised for the good of the sector’s progress. This is one area we are yet to improve in South Africa.

Of course, we have a structurally different agricultural sector, partly because of our various histories. In South Africa, consideration must be given to the inclusion and support of small-scale farmers.

So, while some in Australia or South Africa may have viewed the other country as a competition, there is room for more collaboration rather than competing. The continuation of visits by industry stakeholders between the two countries and the exchange programmes of researchers and academics is an avenue for deepening the relationships and agricultural progress.

While we can learn from Australia’s biosecurity and other aspects, they, too, have a lot to learn from our thriving farming sector.

8 September 2025

Sydney, Australia

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)