SA has more farmers than you think

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)

Although there are reports of growing maize shortages in some Zimbabwean mills, the country has not altered its policy at this time. We continue to monitor the conditions.

However, it appears that other Southern African countries likely have some maize supplies to carry them for now, thanks to the recent 2024-25 harvest, which was generally good across the region.

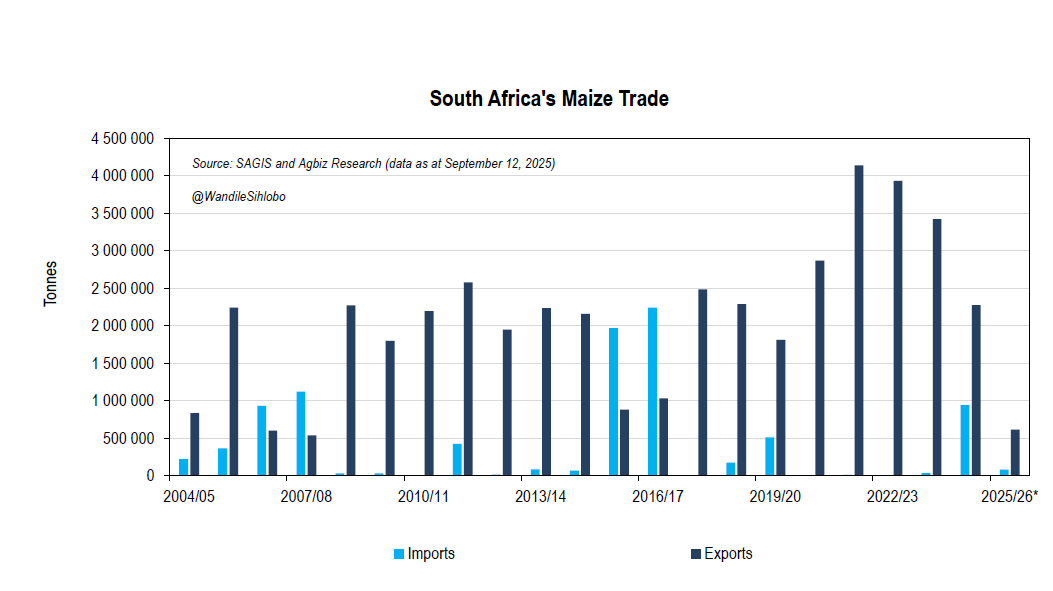

I was looking at South Africa’s weekly maize export activity; typically, there would be decent volumes to the Southern Africa region. But in recent weeks, we have been through relatively quiet weeks in the maize export activity. If we consider last week’s maize export data for South Africa, the country exported a mere 15,164 tonnes of maize, all to the Southern African region.

The recent maize exports placed South Africa’s 2025-26 maize exports at 609,867 tonnes, out of the expected seasonal exports of 2.12 million tonnes. The current marketing year only ends in April 2026. So, we have roughly 1.4 million tonnes of maize for exports in the coming months.

We will likely see more robust export activity later in the year when the supplies in some African countries have depleted, and when Zimbabwe changes its maize policy.

The other crucial regions for South Africa’s maize exports are the Far East region, mainly South Korea, Vietnam, Japan, and Taiwan. These markets are primarily for yellow maize exports, which are for animal feed. White maize exports are typically for the African markets. We have also seen Venezuela appearing on South Africa’s maize exports list, mainly for white maize for human consumption.

We will keep an eye on the Zimbabwean maize market.

And domestically, our attention will also soon shift to the new season, which starts next month. The weather forecasts remain favourable for another excellent agricultural season. We will have more to say on that in the coming weeks.

Additional notes: We talk about the exports because South Africa had a robust maize harvest. South Africa’s 2024-25 maize harvest is estimated at 15.80 million tonnes, a 23% increase year-on-year, primarily due to expected annual yield improvements. (The 2024-25 production year corresponds with the 2025-26 marketing year).

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)

It would be helpful if the Zimbabwean government could reverse its current ban on maize imports. We understand that it is in place to protect domestic farmers, to some extent, during the months following harvest. But there is growing evidence that the supply is constrained. Some milling firms already face challenges because of the maize shortage.

As we argued a few days ago, Zimbabwe likely doesn’t have sufficient maize supplies for their annual needs. We believe, based on data from the United States Department of Agriculture (USDA), that Zimbabwe’s maize production is around 1.3 million tonnes. Given the annual consumption of 2.0 million tonnes, they naturally need about 700,000 tonnes to fulfil their needs.

However, we had anticipated that the needs would be more severe by the end of the year and into the first quarter of 2026. We thought the current harvest would carry them for now, albeit with artificially higher prices in the context of a ban on imports of affordable maize from the world market. But it appears that the supplies are constrained already.

Under this context, while it is understandable that the Zimbabwean government wants to protect farmers, it would be beneficial for them to consider lifting the ban now and supporting the households.

We discussed the details of the issue in our AgriView episode last week, which you can watch here.

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)

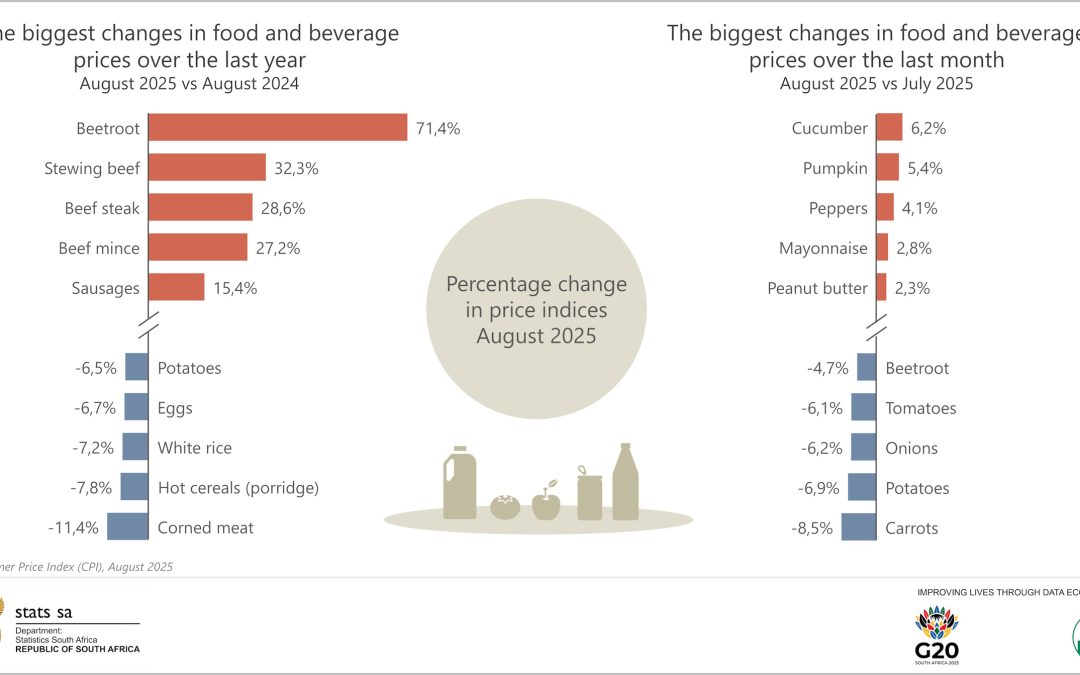

We see a constructive picture of South Africa’s food price inflation, easing at 5.2% in August 2025, from 5.5% in the previous months (the details are on this Stats SA chart). South Africa has an abundant harvest of grains, fruits, and various vegetables, and the benefits of this are starting to show in prices. It is these products that were the major drivers of the moderation in price inflation.

A key product that many are watching is meat, particularly beef (and red meat products), which has remained elevated, although slaughtering has resumed in major feedlots across the country. The issue is that South Africa is experiencing a foot and mouth disease outbreak.

Initially, the panic buying, not necessarily a shortage of product, was the main driver of meat prices. This is when the country’s largest feedlot announced the cases in its facility. This led to concerns about red meat supplies and some panic buying, thus pushing up prices. The slaughtering has now resumed in the major feedlots, although foot and mouth remains a profound challenge in the country.

We must also remember that when there are outbreaks of disease, South Africa is temporarily restricted from various export markets, which, over time, increases the supply of red meat into the local market.

This all sounds encouraging for a consumer, but the red meat producers in South Africa are under enormous financial pressure. This has been a challenging year.

From a consumer perspective, we anticipate the red meat picture (prices) will ease in the coming months. We are already seeing better prices at the farm level. This, together with better grain prices, all point to a potentially moderating food price inflation for the coming months.

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)

In a year where trade continues to dominate headlines after the U.S. started imposing higher tariffs against its trading partners, we take a look at South Africa’s recent agricultural exports data to gauge the early impact of the changing trade environment.

Encouragingly, the start of the year has remained positive for the sector. After solid export activity in the first quarter of the year, South Africa’s agricultural exports totalled US$3.71 billion in Q2, up 10% from the same period a year ago. This is again a function of both higher volumes of various product exports and better commodity prices.

The products that dominated the exports list in the second quarter of the year were mainly citrus, apples and pears, maize, wine, nuts, fruit juices, dates, pineapples, avocados, grapes, and wool, amongst other products. While there remains a need for further improvement in the efficiency of the ports, there has been a material improvement compared to recent years. Agricultural export activity in the second quarter experienced less friction than in the recent past.

From a regional perspective, the African continent maintained the lion’s share of South Africa’s agricultural exports in the second quarter of 2025, accounting for 40% of the total value. The products leading the exports list in the African continent were maize, maize meal, apples and pears, sugar, fruit juices, wheat, wine, soybean oil, and sunflower oil, amongst other products.

The EU was South Africa’s second-largest agricultural market, accounting for a 22% share. Citrus, apple and pears, dates, pineapples, avocados, guavas, mangos, wine, grapes, and nuts were amongst the primary agricultural products South Africa exported to the EU in the second quarter of 2025.

As a collective, Asia and the Middle East were the third-largest agricultural markets, accounting for 21% of the total agricultural exports in the second quarter of 2025. The exports to this region primarily included citrus, apples and pears, nuts, wool, maize, beef, mutton, wine, berries, and fruit juices, among other products.

The Americas region accounted for 7% of South Africa’s agricultural exports in the second quarter of the year. The main exported products include citrus, fruit juices, wine, nuts, apricots, apples, pears, and grapes. Given ongoing concerns about the higher tariffs South Africa faces in the U.S., it is worth highlighting that some exporters may have taken advantage of the 90-day pause of the higher tariffs and exported more volume than usual during that period.

Notably, South Africa’s agricultural exports to the U.S. surprisingly increased by 26% in the second quarter of 2025, from the same period a year ago, at US$161 million. The composition of the products hasn’t changed; it is mainly citrus wine, fruit juices, and nuts, amongst other typical agricultural exports to the U.S. The fact that South Africa generally has a large fruit harvest also contributed to this huge increase, which far surpassed the average typical quarterly growth in exports to the U.S., which is about 9%.

Also worth highlighting is that the rise underscores in a way the importance of the U.S. market for some producers, while it remains somewhat smaller from a national perspective. South Africa’s agricultural exports to the U.S. were still 4% in the second quarter of 2025 (which is part of the 7% exports to the Americas region we mentioned above).

Again, the 4% share of the U.S. in the overall South African agricultural exports is not a small value, as few specific industries are primarily involved in these agricultural exports. These are mainly citrus, grapes, wine, and fruit juices. Since the start of AGOA, the percentage share of South Africa’s agricultural exports to the U.S. has remained at these levels.

From now on, a great deal hinges on whether South Africa succeeds in securing favourable trade terms with the U.S. The rest of the world, including the United Kingdom, accounted for 10% of South African agricultural exports in the second quarter of 2025.

The country also imports various agricultural products. In the second quarter of 2025, South Africa’s agricultural imports totalled US$1.81 billion, a 5% decline year-over-year, according to data from Trade Map. The result is from slightly lower value and volume of major products South Africa imports, such as wheat, palm oil, poultry, and whiskies.

As we have highlighted before, South Africa lacks favourable climatic conditions for growing rice and palm oil and thus relies on imports of these products. Regarding wheat, South Africa imports nearly half of the annual consumption. In the Free State province, which was once one of the country’s major wheat-growing regions, production has declined notably over time due to unfavourable weather conditions and profitability challenges of wheat compared to other crops. Meanwhile, imports account for around 20% of the annual domestic poultry consumption.

Subsequently, when we account for the exports and imports, South Africa’s agriculture sector recorded a trade surplus of US$1.90 billion in the second quarter of 2025, up 29% from the previous year. The higher exports and the decline in imports are the major boost to this better trade surplus.

Policy considerations

In the current environment of heightened geoeconomic tensions, South Africa’s export-oriented agricultural sector must work to maintain its current export markets and expand into new ones. The focus for both policymakers and agribusinesses and organized agriculture should be on the following aspects:

First, South Africa should maintain its focus on improving logistical efficiency. This entails investments in port and rail infrastructure, as well as improving roads in farming towns. Second, South Africa must work diligently to maintain its existing markets in the EU, Africa, Asia, the Middle East, and the Americas.

Lastly, the South African Department of Trade, Industry and Competition, the Department of International Relations and Cooperation, and the Department of Agriculture should lead the way in expanding exports to current markets and exploring new ones. South Africa should expand market access to some key BRICS countries, such as China, India, Saudi Arabia, and Egypt. The emphasis on the BRICS grouping should be on the need to lower import tariffs and address artificial phytosanitary barriers that hinder deeper trade within this grouping. The discussion in BRICS should move beyond the general rhetoric of intentions to meaningful trade arrangements.

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)

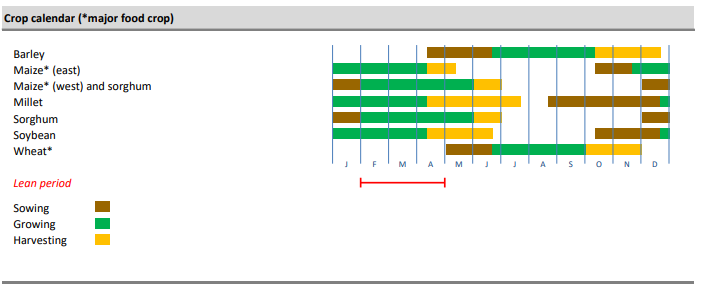

Next month, October 2025, we will start our 2025-26 maize and soybean production season in South Africa. Other crops will be later in the year. The chart below illustrates our grain production calendar. The brown parts are the start of the planting periods, with the letters representing the months of the year.

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)

The economists Daan Steenkamp and Jacques Quass de Vos make an important observation about the shortfalls in South Africa’s geoeconomic approach in their latest Business Day article (“SA’s geoeconomic gamble is not paying off”, September 15).

Among other things, they argue correctly that the BRICS grouping has provided limited economic benefit to South Africa. The exception is China, with which South Africa has deeper trade relations, though more could be done in agriculture and other sectors of our economy if we had a free trade agreement.

However, the path forward in this challenge is not necessarily to abandon the BRICS bloc but to elevate its economic ambition. BRICS remains a loose, informal grouping with no sound economic or trade approach that keeps the countries together.

In fact, when one considers the intra-BRICS trade, it quickly becomes clear that little is happening in the grouping beyond political matters, with China again being an exception for many countries on trade matters. The constraining factor, as a result of the lack of a BRICS free trade agreement, is the observation that Steenkamp and De Vos make about the low exports and investment in this region.

Much of South Africa’s economic relationships and investments are with the Western world. But South Africa doesn’t have the luxury to choose either or. Our approach should be to balance and retain our existing trading partners in Europe, the Americas, and other parts of the world, while simultaneously pushing for an ambitious trade agreement within BRICS and exploring ways to attract investments.

Our focus should be on bettering South Africa by skilfully navigating the complex geoeconomic environment of the day.

In essence, we should (economically at least) reach out to and be friends with all who want to do business with us. India, by the way, is likely to be a global engine of growth for the next two decades or so, as its per capita GDP catches up. So, deepening trade is key to long-term progress.

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)