Although there are reports of growing maize shortages in some Zimbabwean mills, the country has not altered its policy at this time. We continue to monitor the conditions.

However, it appears that other Southern African countries likely have some maize supplies to carry them for now, thanks to the recent 2024-25 harvest, which was generally good across the region.

I was looking at South Africa’s weekly maize export activity; typically, there would be decent volumes to the Southern Africa region. But in recent weeks, we have been through relatively quiet weeks in the maize export activity. If we consider last week’s maize export data for South Africa, the country exported a mere 15,164 tonnes of maize, all to the Southern African region.

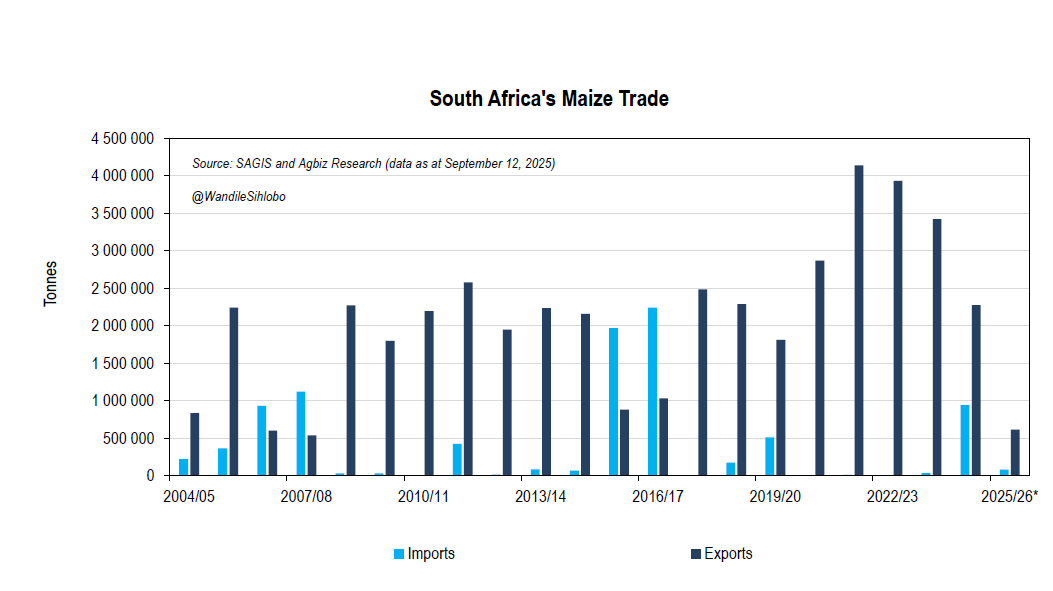

The recent maize exports placed South Africa’s 2025-26 maize exports at 609,867 tonnes, out of the expected seasonal exports of 2.12 million tonnes. The current marketing year only ends in April 2026. So, we have roughly 1.4 million tonnes of maize for exports in the coming months.

We will likely see more robust export activity later in the year when the supplies in some African countries have depleted, and when Zimbabwe changes its maize policy.

The other crucial regions for South Africa’s maize exports are the Far East region, mainly South Korea, Vietnam, Japan, and Taiwan. These markets are primarily for yellow maize exports, which are for animal feed. White maize exports are typically for the African markets. We have also seen Venezuela appearing on South Africa’s maize exports list, mainly for white maize for human consumption.

We will keep an eye on the Zimbabwean maize market.

And domestically, our attention will also soon shift to the new season, which starts next month. The weather forecasts remain favourable for another excellent agricultural season. We will have more to say on that in the coming weeks.

Additional notes: We talk about the exports because South Africa had a robust maize harvest. South Africa’s 2024-25 maize harvest is estimated at 15.80 million tonnes, a 23% increase year-on-year, primarily due to expected annual yield improvements. (The 2024-25 production year corresponds with the 2025-26 marketing year).

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)