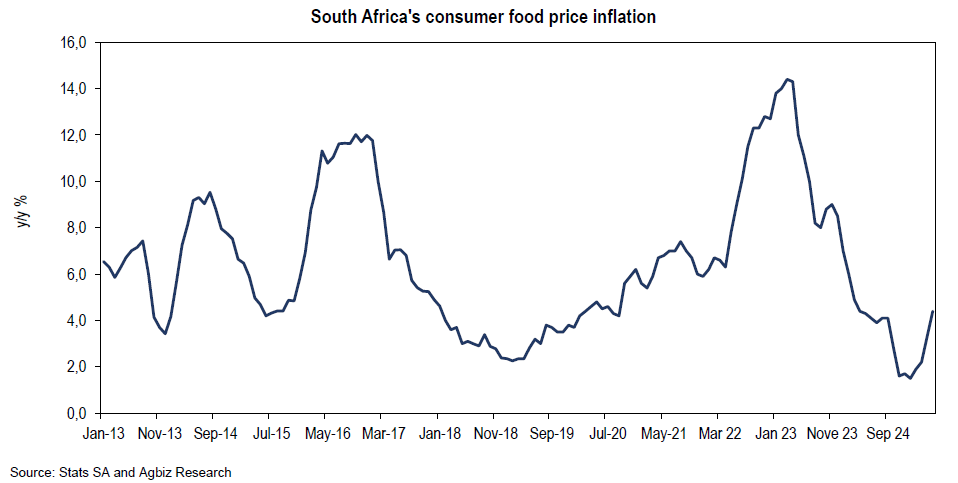

At a time when avian influenza and foot-and-mouth disease have been in the headlines, it is reasonable for people to closely watch consumer food price inflation to gauge the pass-through of these issues.

On June 18, we had inflation data for May 2025. South Africa’s consumer food price inflation has continued to accelerate; however, this should not be a concern, as the recent upticks are in line with expectations and may be short-lived.

The data released earlier today by Statistics South Africa shows that consumer food price inflation accelerated to 4.4% in May from 3.3% in April 2025.

The acceleration in price inflation of meat, fish, and other seafood, oils and fats, fruit and nuts, and vegetables mainly underpinned the uptick.

Meanwhile, the other products remained roughly unchanged, while others experienced slowing price inflation.

Regarding meat, the key issues that have dominated the headlines are the outbreak of avian influenza in Brazil and its potential impact on domestic poultry supplies and prices. The second concern relates to beef supplies following the outbreak of foot-and-mouth disease.

Still, we believe the effects of these two events have not yet been fully factored into the current price trends. The price increases we observe are essentially a continuation of the past few months, mainly due to base effects, the rising domestic demand, and the suppliers’ window to pass on some costs they have experienced stemming from higher feed prices over the past couple of months before the recent cooling of maize and soybean prices.

In the case of beef, it is essential to note that, unlike what is generally stated in the commentary, when an outbreak occurs, red meat exports are temporarily banned, which increases local supplies.

In the past, this led to a mild decline in red meat prices. This is why we have doubts about the talk of potential sharp increases in red meat prices in the coming months due to the outbreak of foot-and-mouth disease.

Regarding poultry, South Africa has temporarily restricted imports from Brazil, one of its largest suppliers of poultry products, due to an outbreak of avian influenza there.

However, this ban is for the short term, and the authorities have indicated that South Africa will restrict imports only in the affected areas, not the entire country of Brazil. This means that any poultry supply issue, if it arises, will be temporary.

Based on these two factors, we are inclined to believe that the recent uptick in meat inflation may prove to be short-lived.

Regarding fruits and vegetables, we observe a recovery in the supply of various products in the fresh produce markets and suspect that prices may moderate in the coming months. The recent increases reflect the disruptions in supplies that have occurred in recent months, some of which are related to weather issues.

Similarly, oil and fat prices may soften in the coming months as we are starting to see this trend internationally, and we are an importer of a range of vegetable oils. For example, the FAO Vegetable Oil Price Index averaged 152.2 points in May, 4% lower than in April. Lower prices of palm, rapeseed, soy, and sunflower oils drove this.

On a positive note, we see a moderation in grain-related product prices, which reflects the better harvest in the 2024-25 season domestically, as well as the better rice, wheat, and maize harvest globally. We expect this current moderation to continue in the coming months.

If you enjoyed this post, please consider subscribing to my newsletter here for free. You can also follow me on X (@WandileSihlobo)